Lend with confidence, not assumptions.

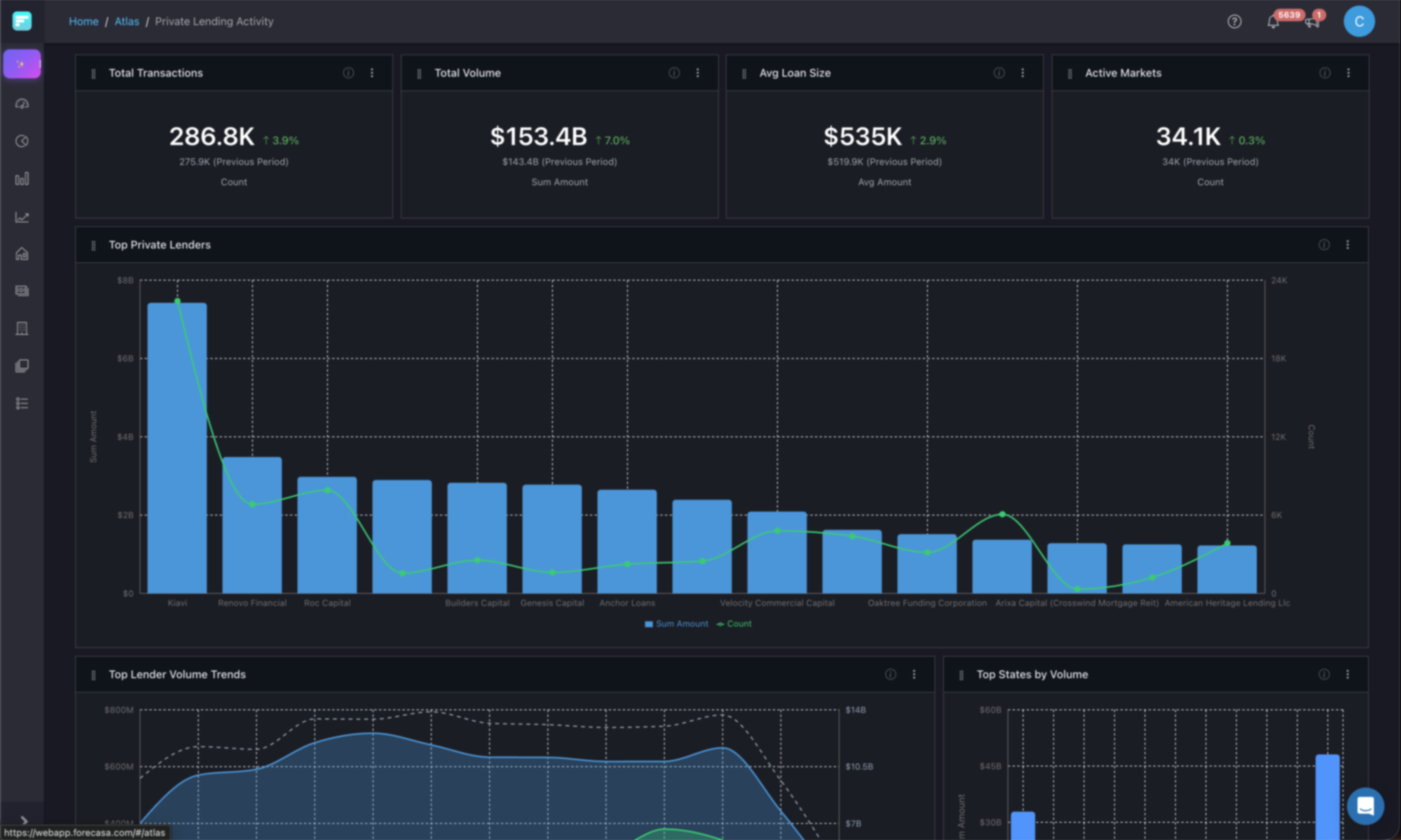

Forecasa gives private lenders the market clarity to originate smarter, manage risk earlier, and outpace competitors.

Without market clarity

- Originating in markets based on gut feel, not data

- No visibility into competitor lending activity

- Borrower track records unverifiable beyond their application

- Portfolio concentration risk discovered too late

With Forecasa

- Real-time market analytics show where to deploy capital

- Competitor market share and origination patterns at your fingertips

- Full borrower history across lenders and transactions

- Continuous exposure monitoring with alerts

Your decisions, answered

Every critical question private & alternative lenders face, mapped to the platform capabilities that answer it.

Where should we originate next?

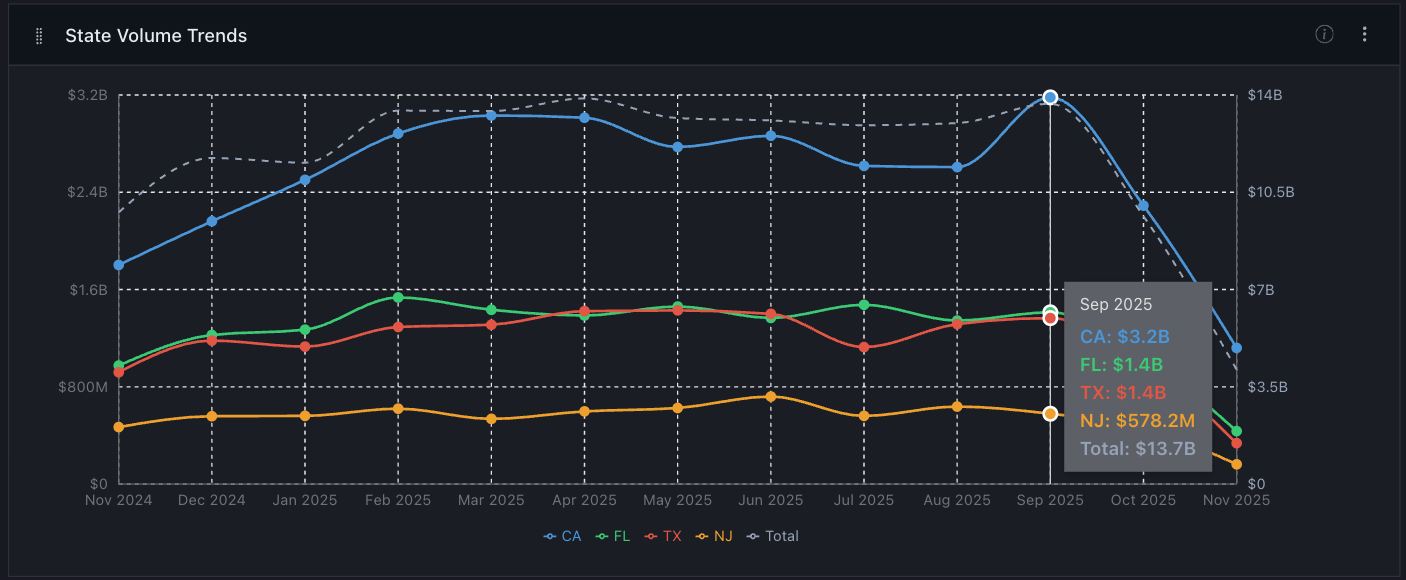

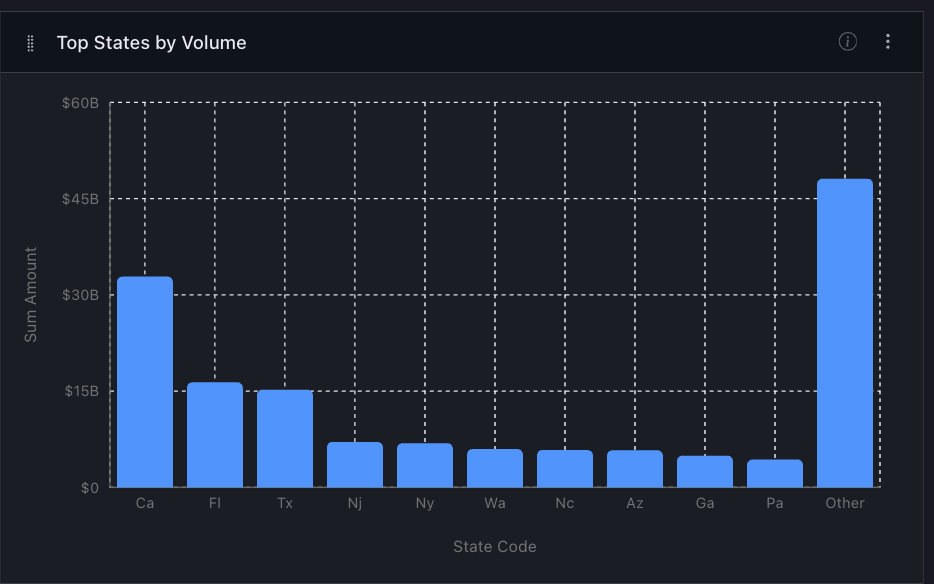

Use Atlas to see real-time origination volume, velocity, and acceleration across MSAs. Identify high-activity markets, track momentum shifts as they happen, and spot the geographies where your capital can work hardest.

Explore capabilities

Volume Trends

Track origination volume over time across states and MSAs to spot accelerating or decelerating markets.

Top Markets

Identify the highest-volume markets for targeted origination and geographic expansion.

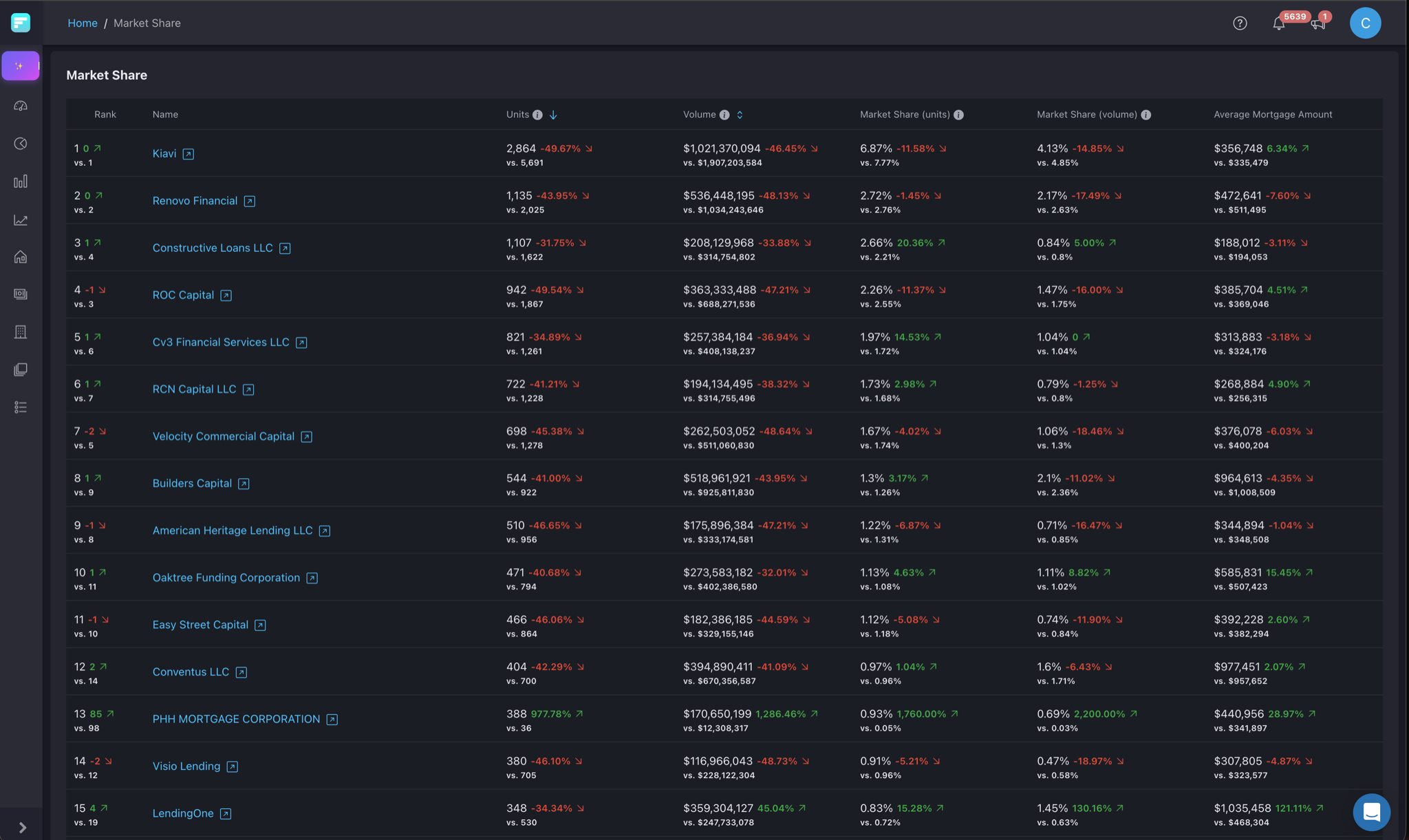

Who are we competing against?

Track competitor market share, geographic expansion, and origination patterns in real time. Run market share reports for any MSA, state, or custom geography to see exactly who's lending where and benchmark your position against the field.

Explore capabilities

Lender Rankings

See which lenders dominate each market by volume, count, and recent activity.

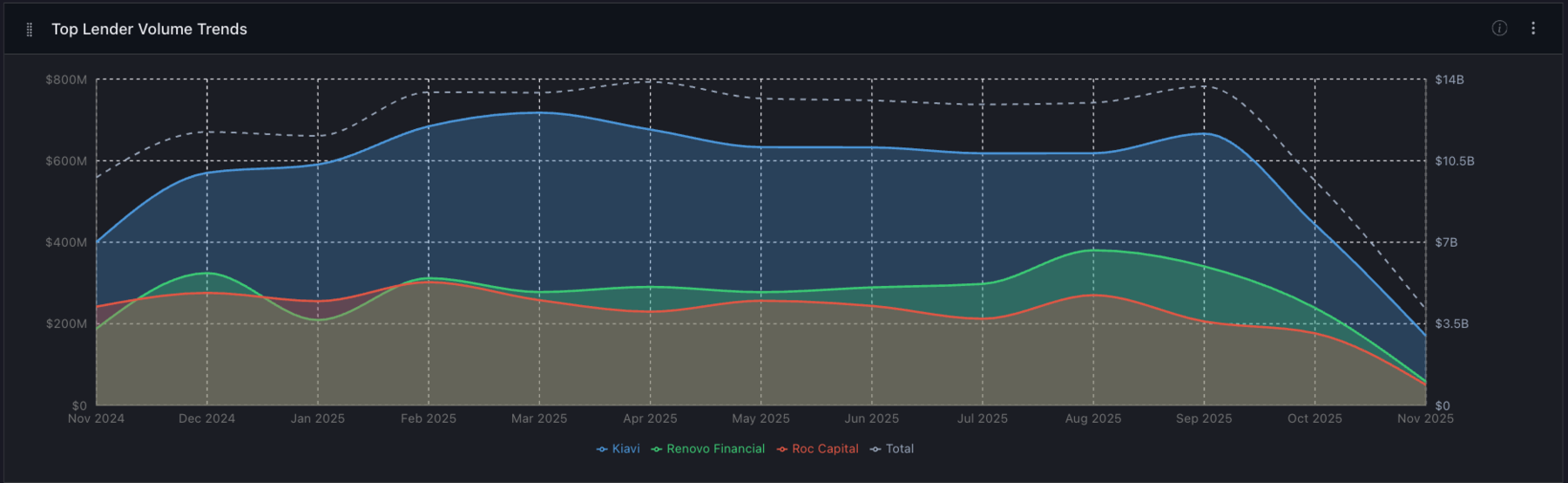

Activity Trends

Monitor how competitor origination changes over time to detect strategic moves early.

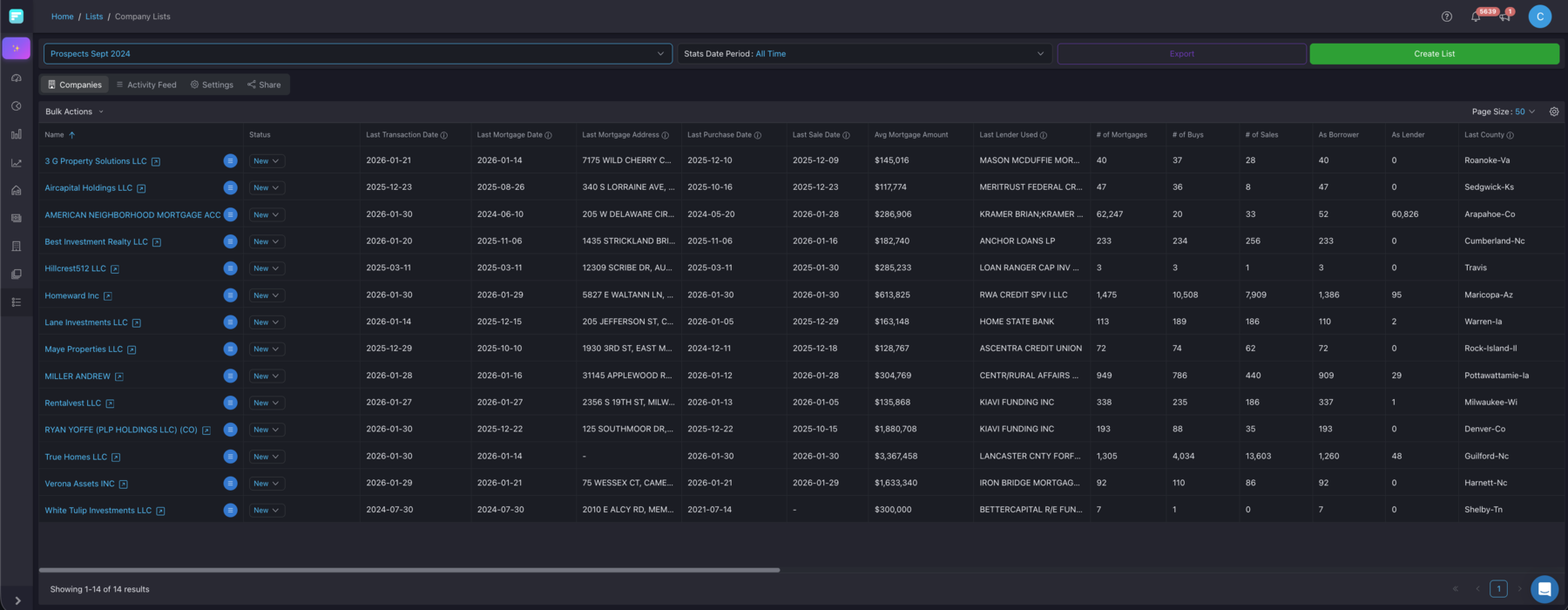

Can we trust this borrower?

Verify borrower experience before you close. Forecasa surfaces a borrower's full lending history, including properties financed, lenders worked with, geographic footprint, and deal velocity, so your underwriting team can assess track record with data, not just a loan application.

Explore capabilities

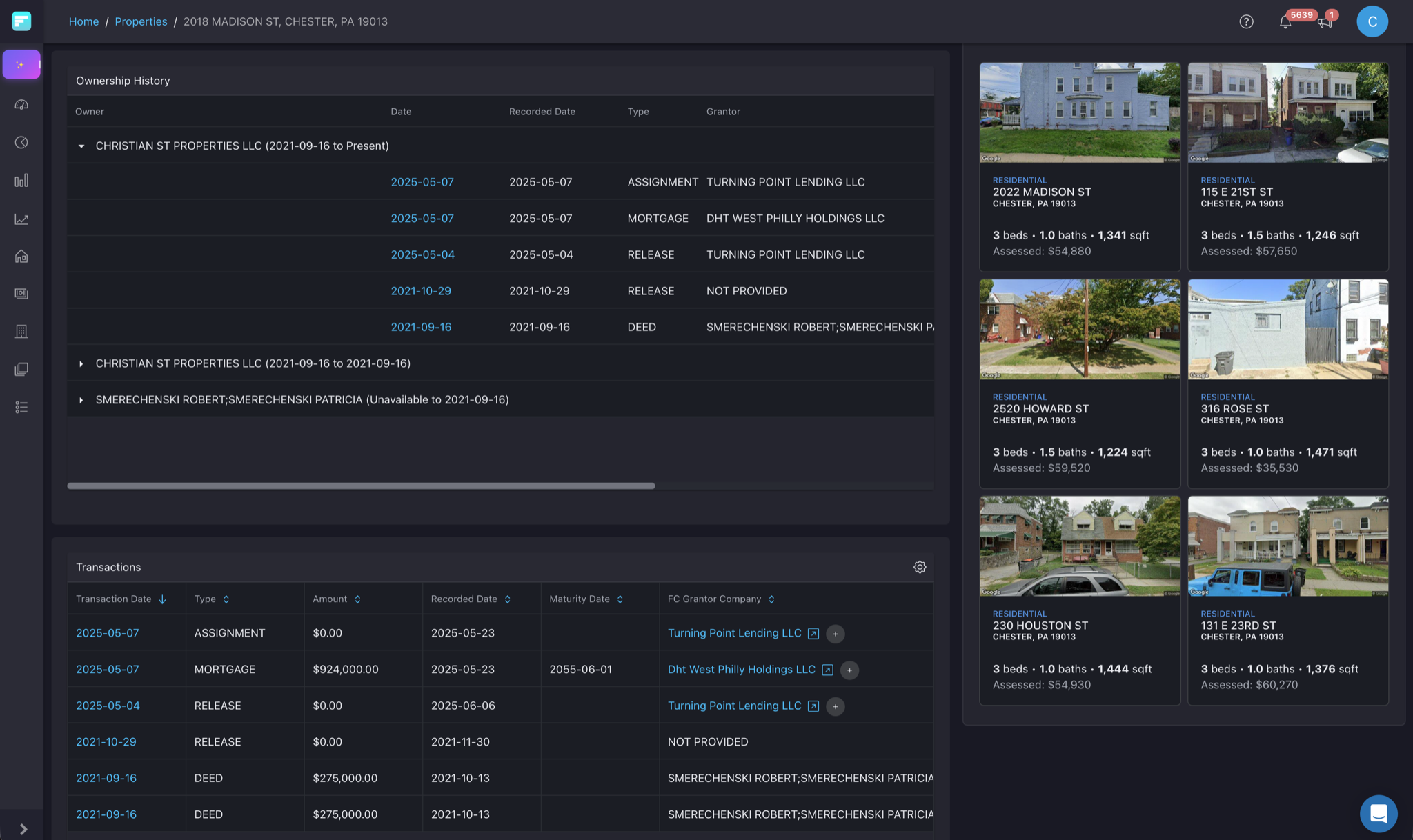

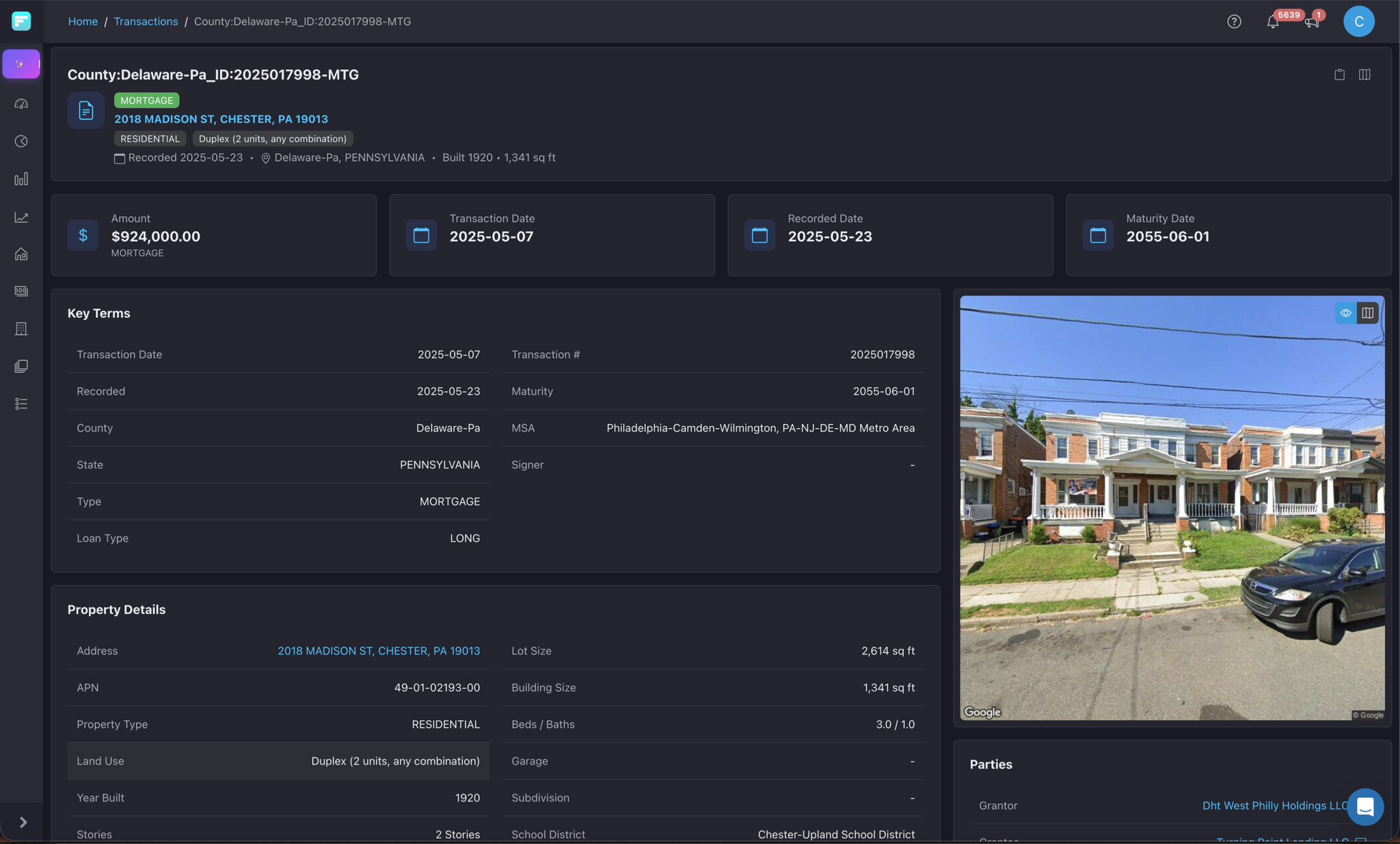

Property History

See the full ownership history of any property, including past owners, transactions, lender involvement, and related properties, to validate collateral and assess deal history.

Borrower Activity

Trace borrower activity across lenders and transactions to verify experience, detect overextension, and assess concentration risk.

Where is our portfolio concentrated?

Visualize geographic and borrower-level exposure across your portfolio. Multi-chart analytics surface concentration hotspots, maturity risk, and market-level stress signals before they impact your book.

Explore capabilities

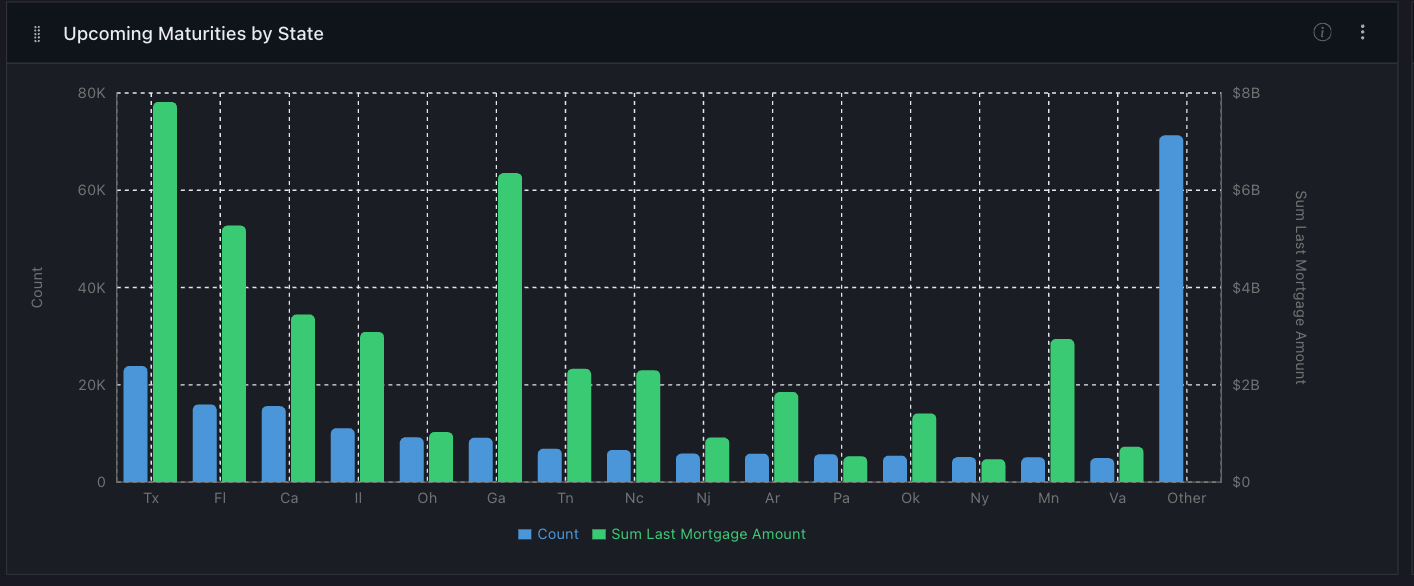

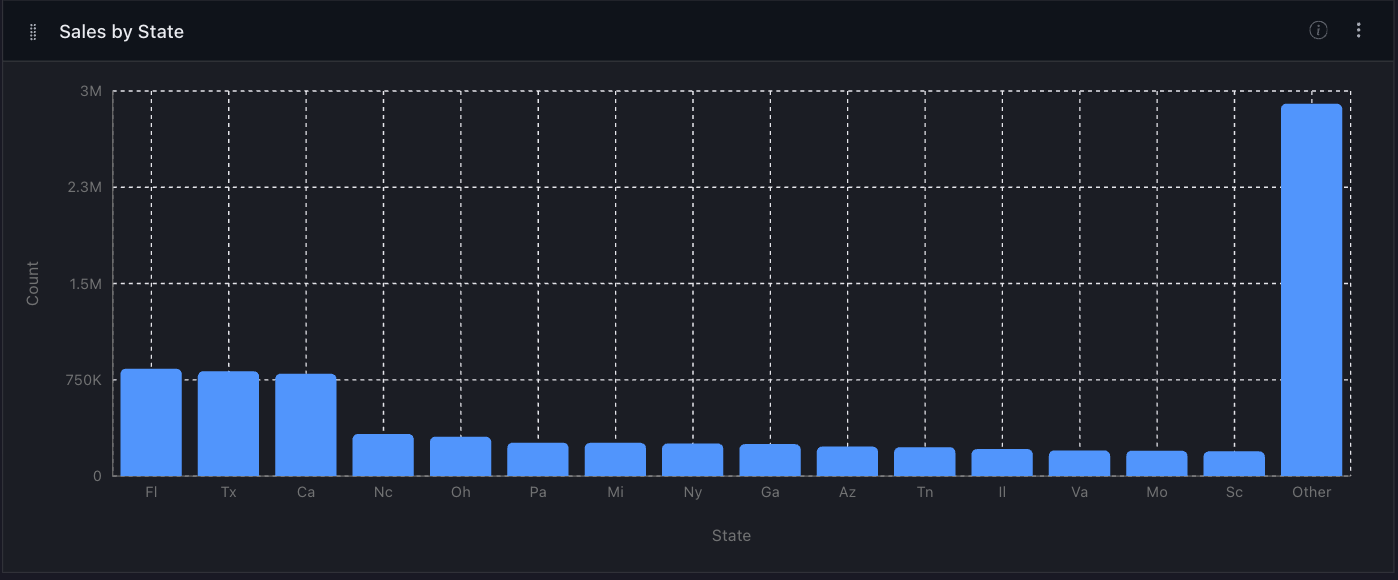

Maturity Analysis

Track upcoming loan maturities by state to anticipate refinance pressure and default risk.

Geographic Exposure

Visualize lending concentration by geography to identify portfolio-level risk hotspots.

How do we stay ahead of changes in our book?

Build watchlists of borrowers, lenders, or markets and get alerted when activity changes. Monitor borrower behavior across your portfolio in real time, including new loans taken, new lenders involved, and geographic shifts, so you're never surprised by what's happening in your book.

Explore capabilitiesBorrower Watchlists

Track specific borrowers and get notified when they take new loans, work with new lenders, or expand into new markets.

Lender Monitoring

Monitor competitor lender activity with alerts on market share changes, geographic expansion, and origination patterns.

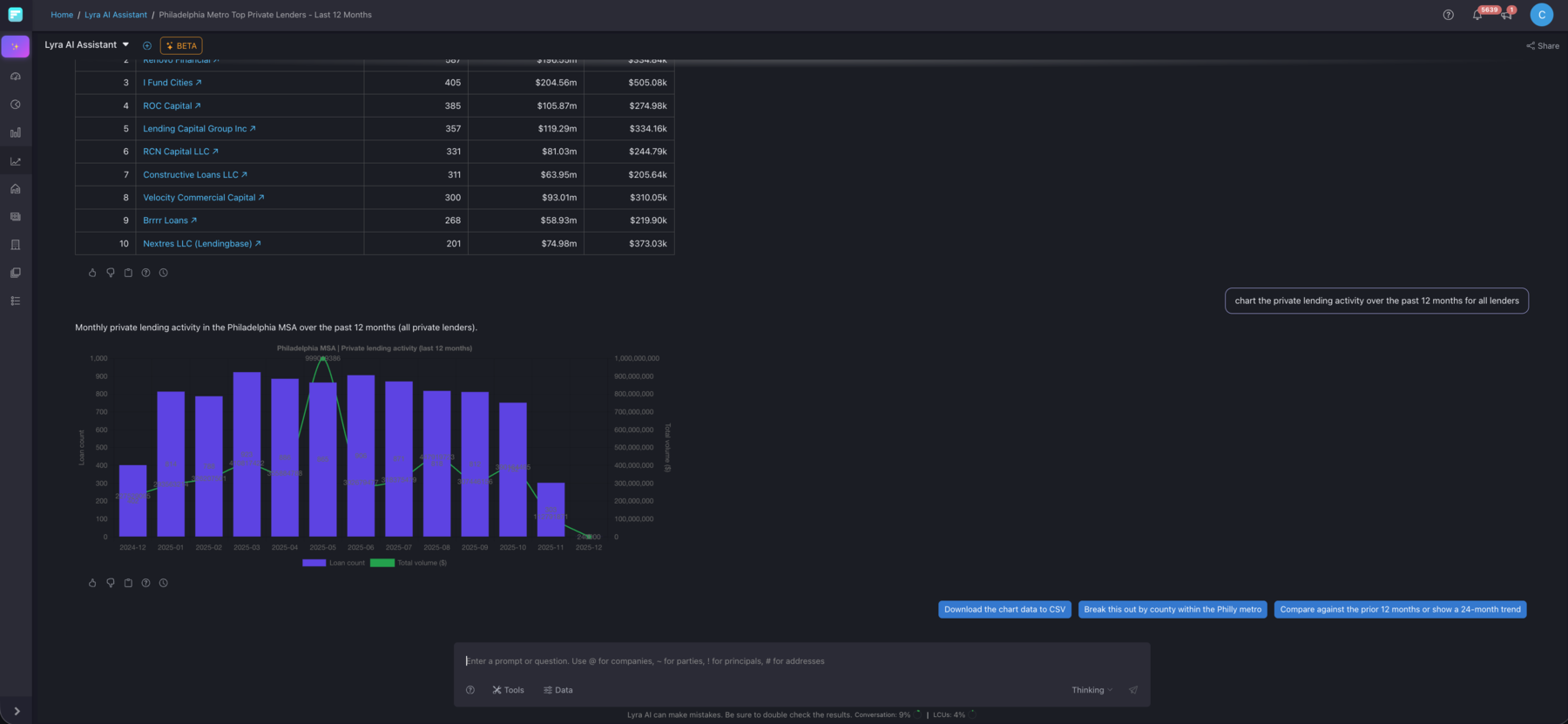

Ask questions, get instant market answers

Lyra is Forecasa's AI-powered market analyst. Ask about lender activity, market trends, or borrower behavior and get data-backed answers in seconds. No dashboards or filters required. Every answer links back to the underlying data so you can verify and explore further.

Learn about LyraRecommended plan

The best starting point for private & alternative lenders.

National

Full visibility across the U.S. private lending market.

- Nationwide market clarity across all states

- Cross-market competitive analysis

- National borrower and lender pattern detection

- Portfolio-wide exposure assessment

- Decision-ready exploration at scale