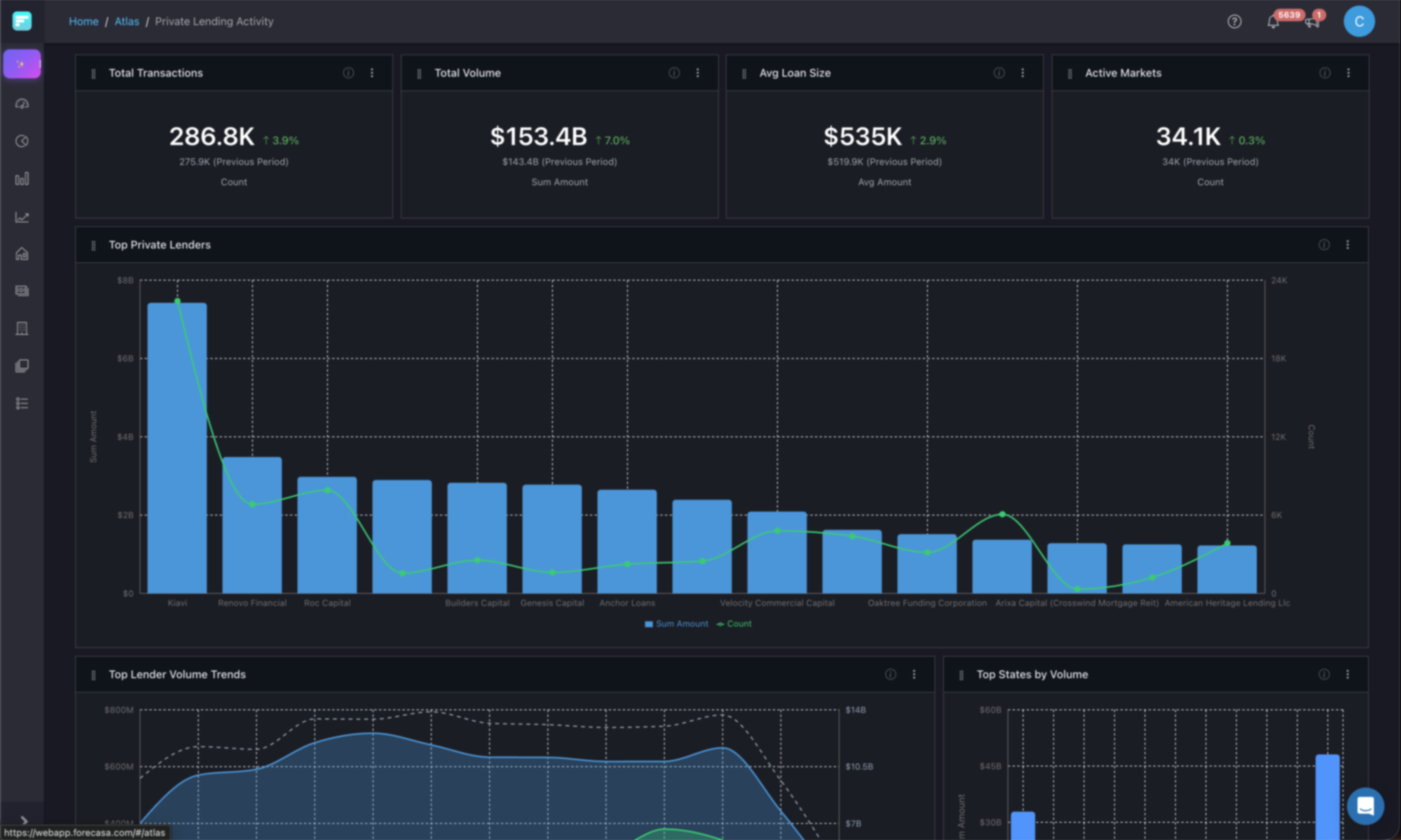

Clarity into private lending markets before markets move.

Decision-ready analytics that reveal market shifts, competitive activity, and emerging risk in time to act.

Built for decision-makers in private credit

Forecasa provides decision-ready market intelligence for professionals allocating capital, pricing risk, and originating loans.

Private & Alternative Lenders

Originate smarter with market-level clarity and competitive awareness.

Capital Providers & LPs

Allocate capital backed by real origination data, not assumptions.

Credit & Securities Investors

Price risk with market-level precision and exposure visibility.

Brokers & Intermediaries

Match deals with the right lenders using real-time market intelligence.

Drive outcomes with decision-ready analytics

Every capability maps to an outcome your team cares about.

Plans built around scope, not feature gates

Choose the coverage that fits your market strategy.

Local

Up to 5 states

Focused clarity for regional operators.

- Market activity tracking in your core geographies

- Competitive awareness within your footprint

- Borrower relationship monitoring

- Risk signal detection at the market level

National

Nationwide coverage

Full visibility across the U.S. private lending market.

- Nationwide market clarity across all states

- Cross-market competitive analysis

- National borrower and lender pattern detection

- Portfolio-wide exposure assessment

- Decision-ready exploration at scale

Enterprise

Full access + API

The complete picture: past, present, and emerging.

- Everything in National

- CRM and workflow integrations

- Advanced relationship and exposure mapping

- Custom data delivery and integration support

- Dedicated account management

Latest insights

Research, analysis, and perspectives on private lending markets.