Allocate capital with market-level clarity.

Forecasa helps capital providers and limited partners evaluate private lending markets, monitor portfolio exposure, and make allocation decisions backed by real origination data.

Without market clarity

- Allocating capital based on lagging quarterly reports

- Partner performance assessed through relationships, not data

- Geographic concentration risk hidden in spreadsheets

- Market sizing relies on third-party estimates

With Forecasa

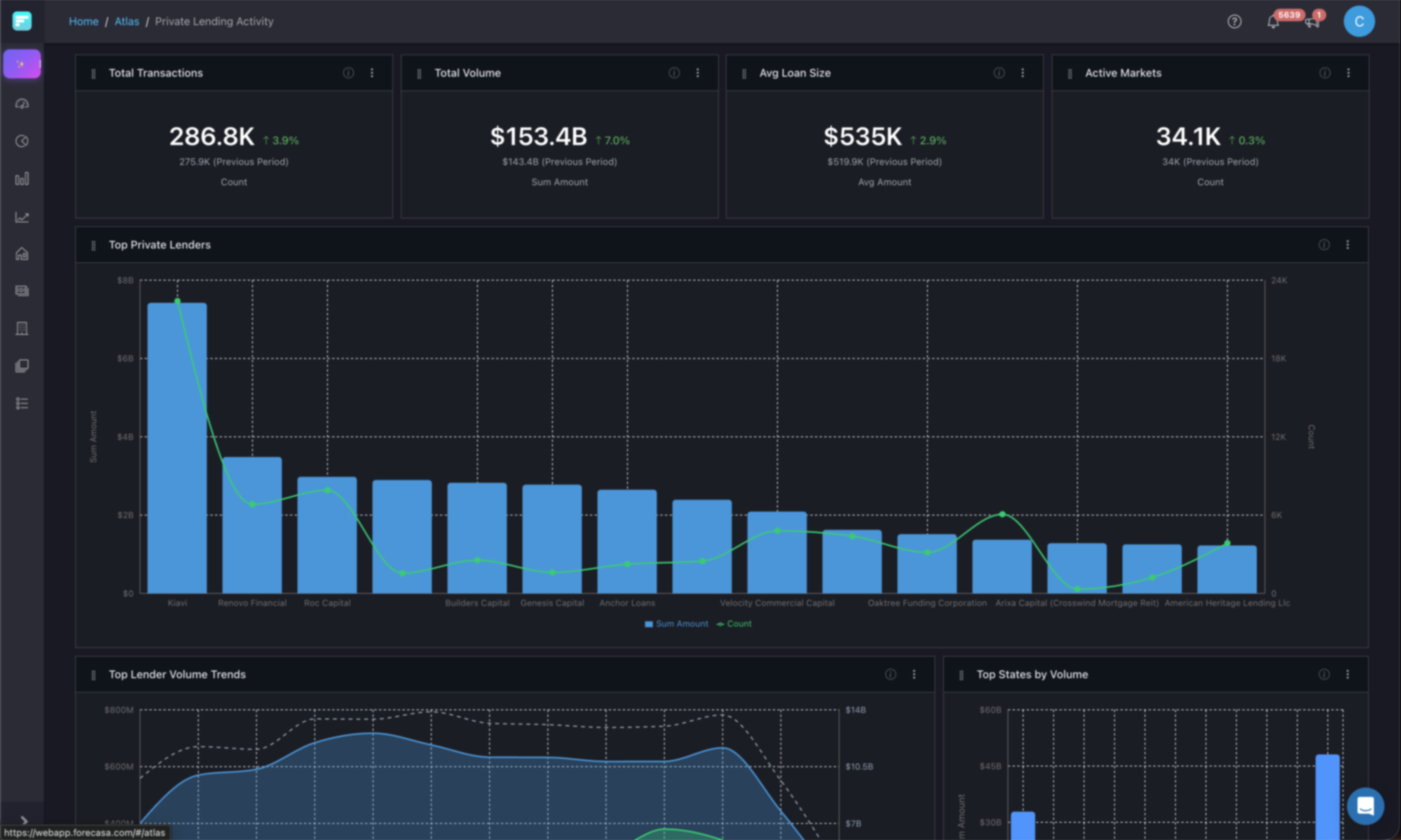

- Real-time market sizing with origination-level granularity

- Partner benchmarking backed by actual activity data

- Interactive exposure mapping at the property level

- Continuous monitoring of partner and market activity

Your decisions, answered

Every critical question capital providers & lps face, mapped to the platform capabilities that answer it.

Which markets deserve more capital?

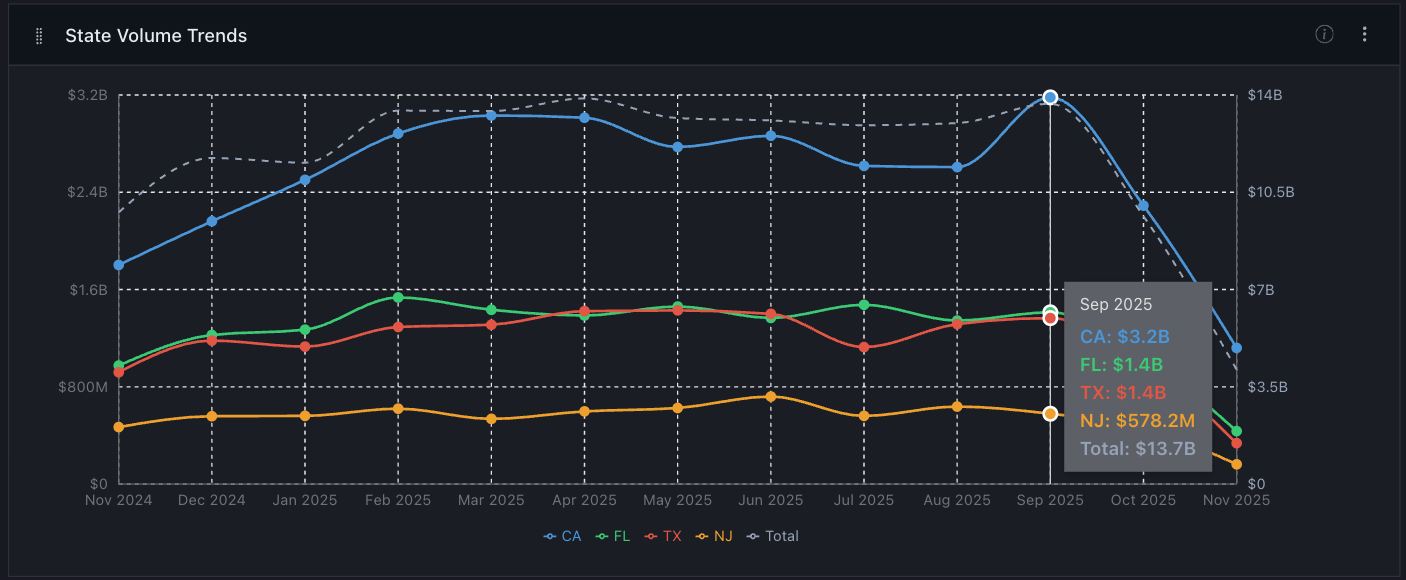

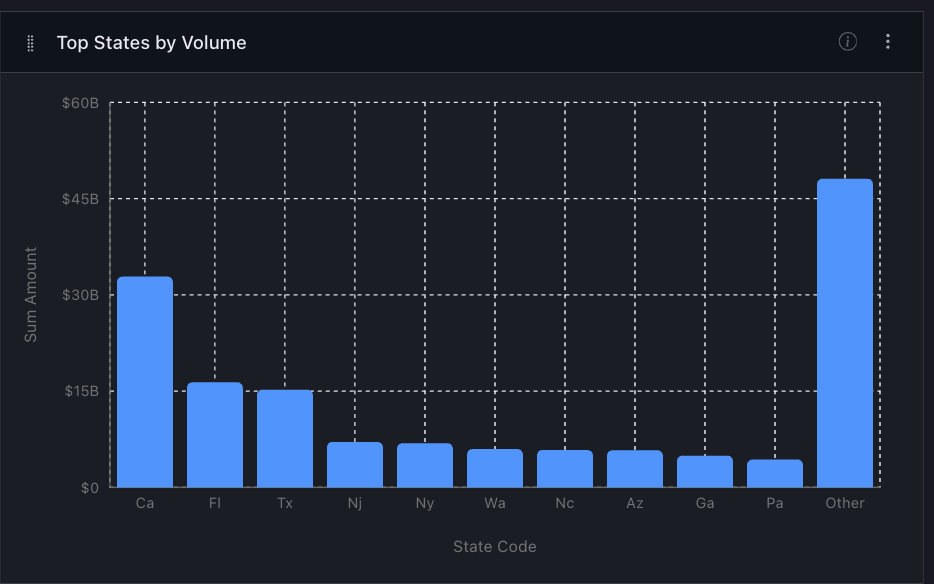

Full visibility into market size, growth trajectories, and lending velocity across the U.S. private lending landscape. Evaluate markets by origination activity, not lagging reports, to allocate capital where momentum is building.

Explore capabilities

Market Growth Patterns

Track origination volume over time across states and MSAs to identify growing markets.

Market Sizing

Compare markets by volume, activity, and momentum to prioritize capital allocation.

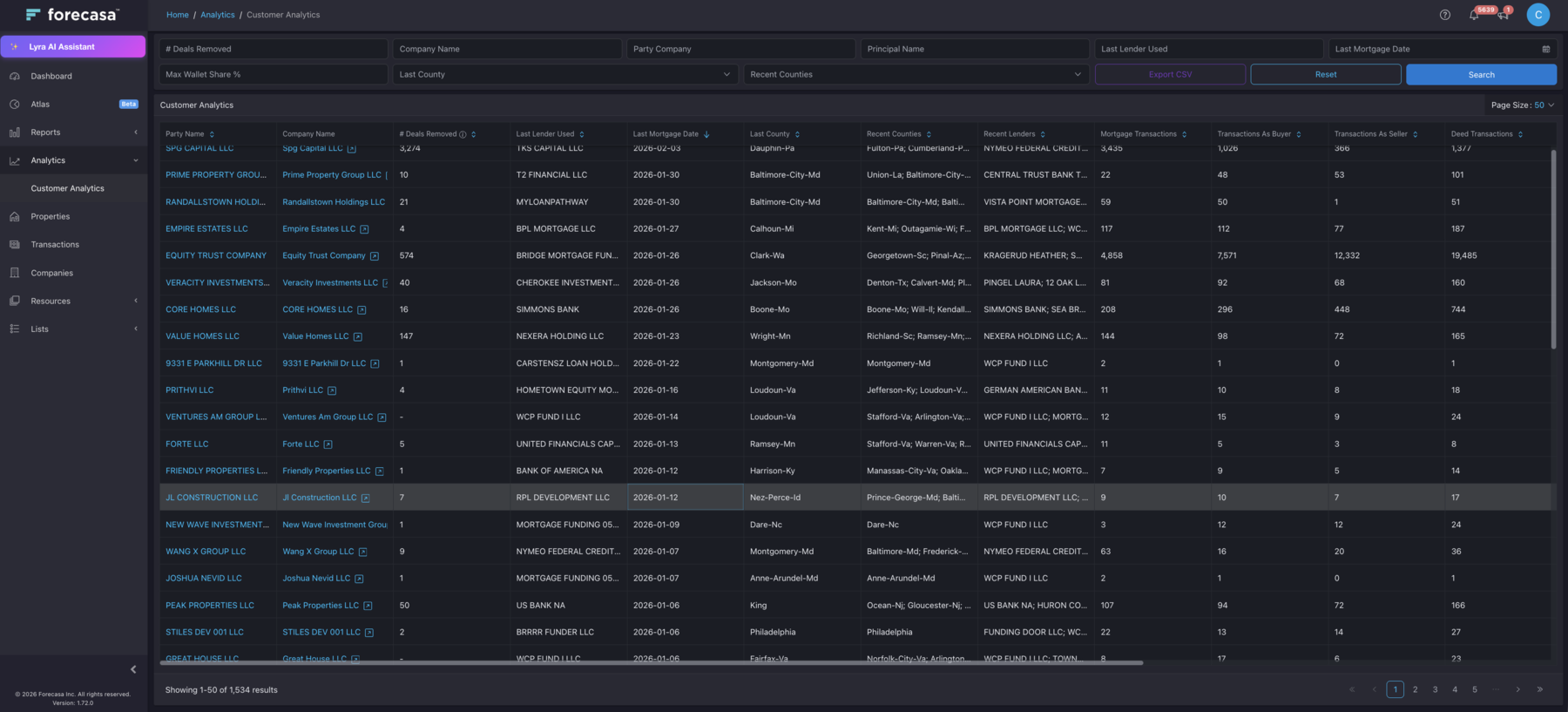

Are our lending partners performing?

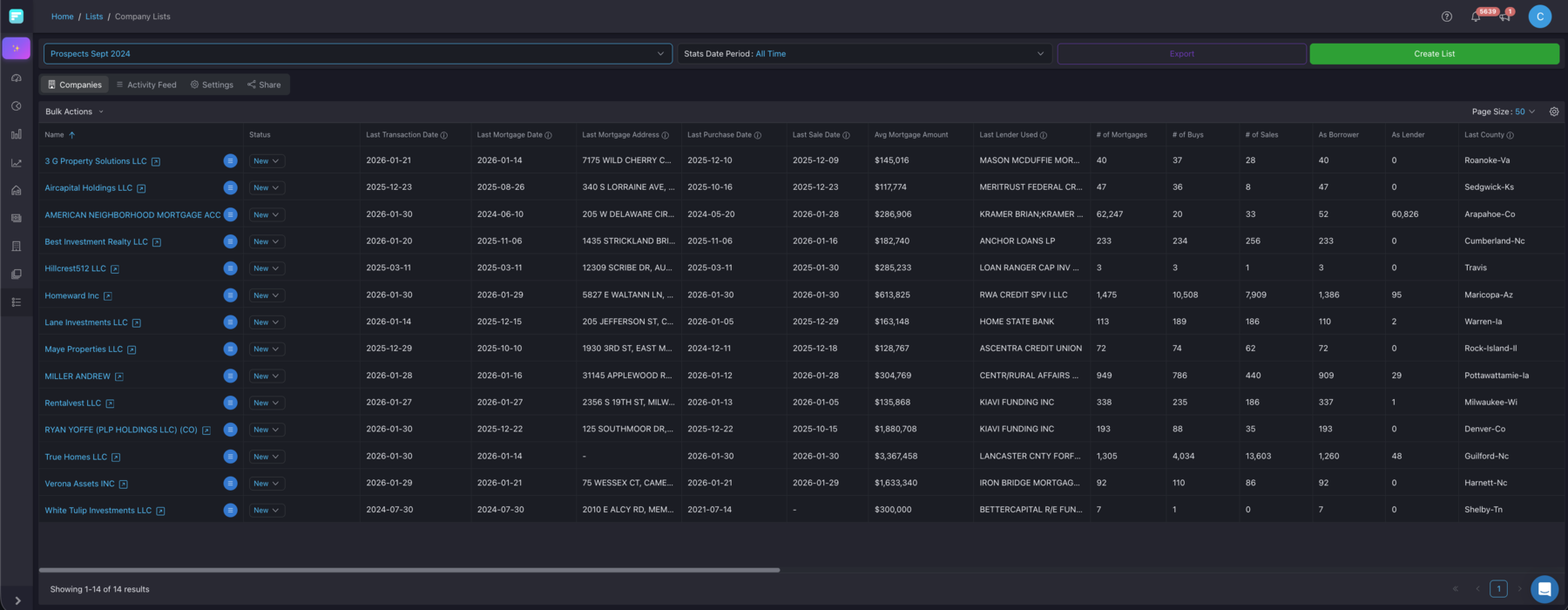

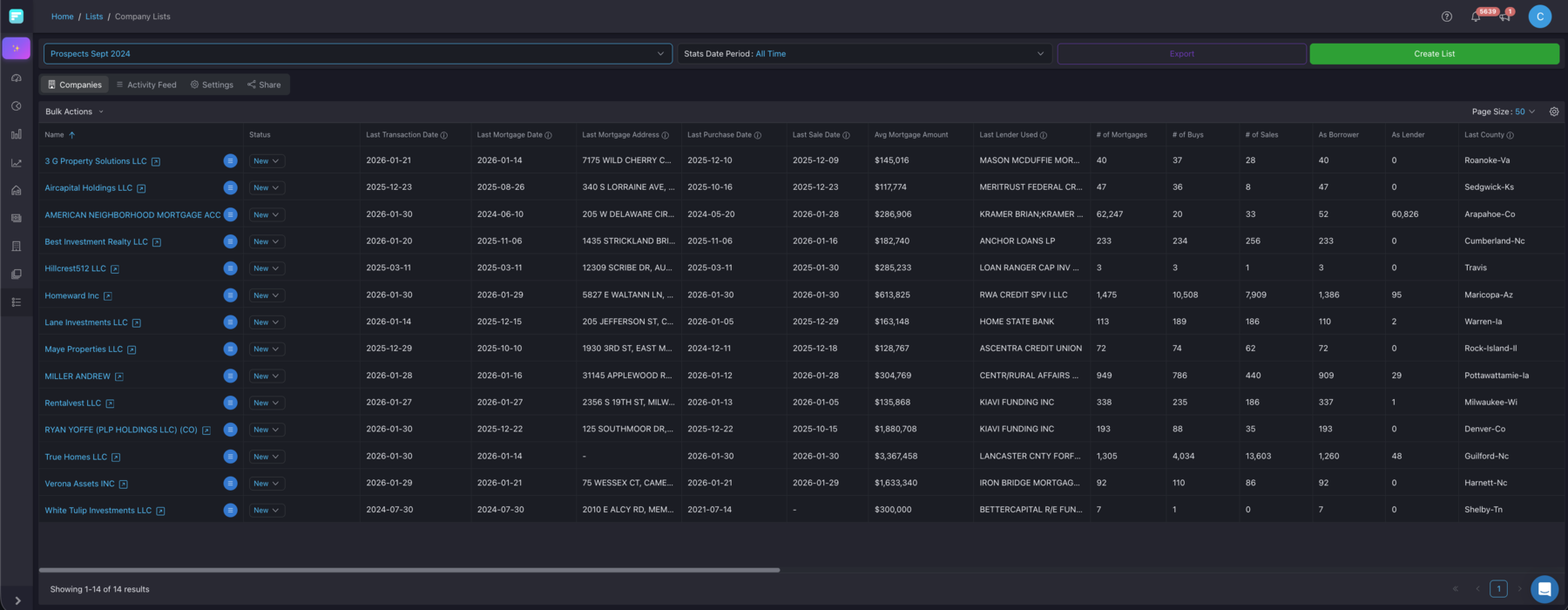

Deep profiles on lending companies including origination history, market focus, and portfolio characteristics. Benchmark partner performance and track activity consistency with data, not just relationship-driven reports.

Explore capabilities

Company Directory

Browse and compare lending companies by volume, geography, and activity recency.

Relationship Mapping

Map cross-portfolio relationships and detect patterns across your lending partners.

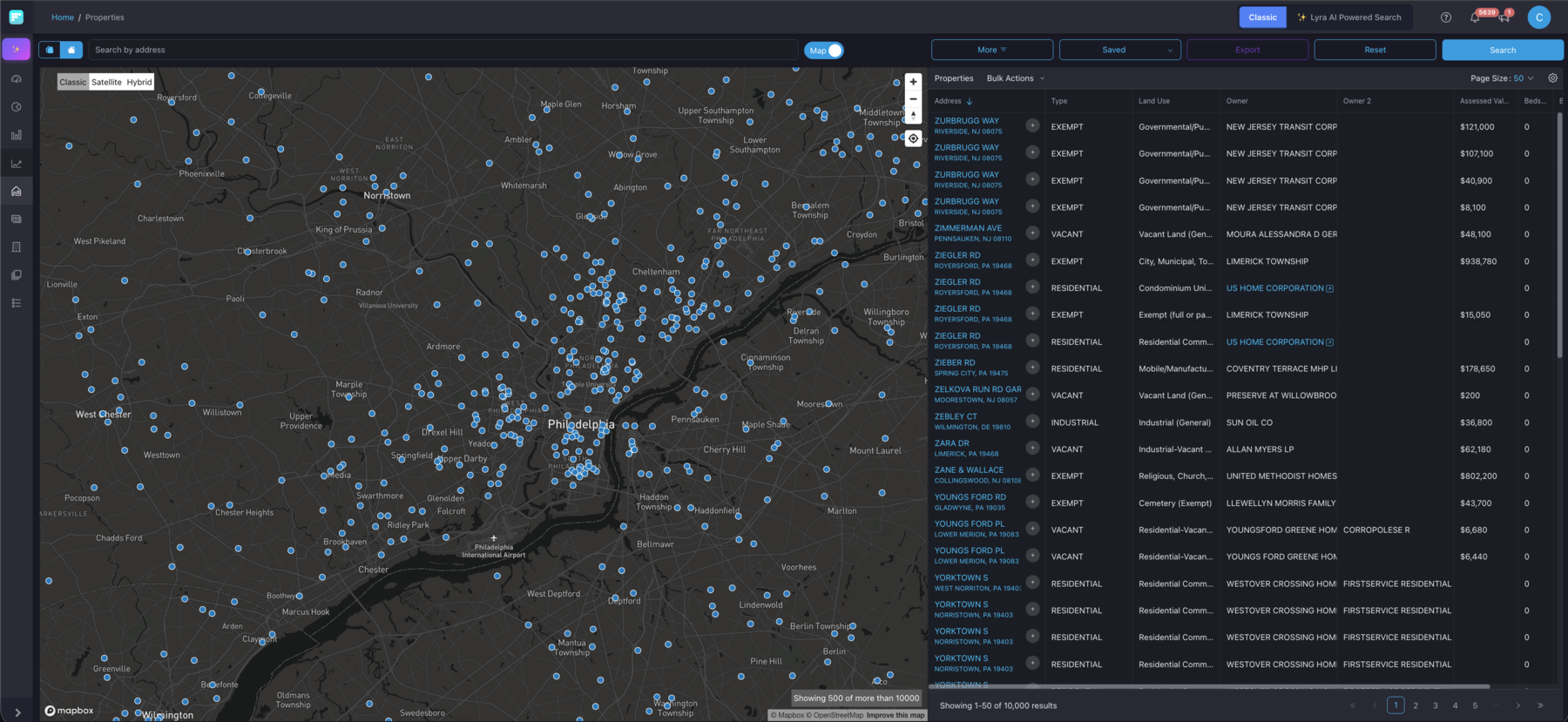

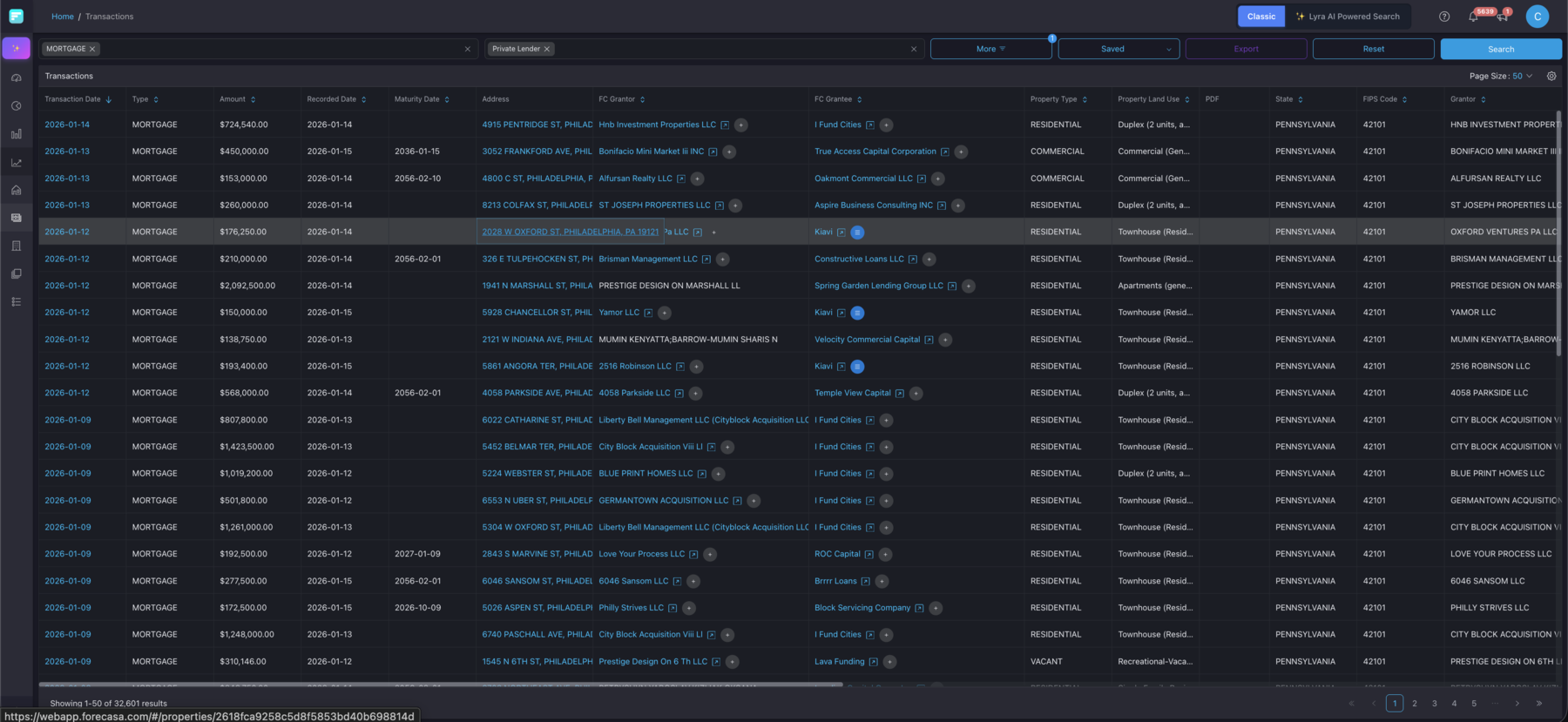

Where is exposure concentrating?

Interactive geographic exploration of property-level lending activity. Drill into any market, lender, or borrower to detect geographic, borrower, and lender-level concentration before it becomes a structural risk.

Explore capabilities

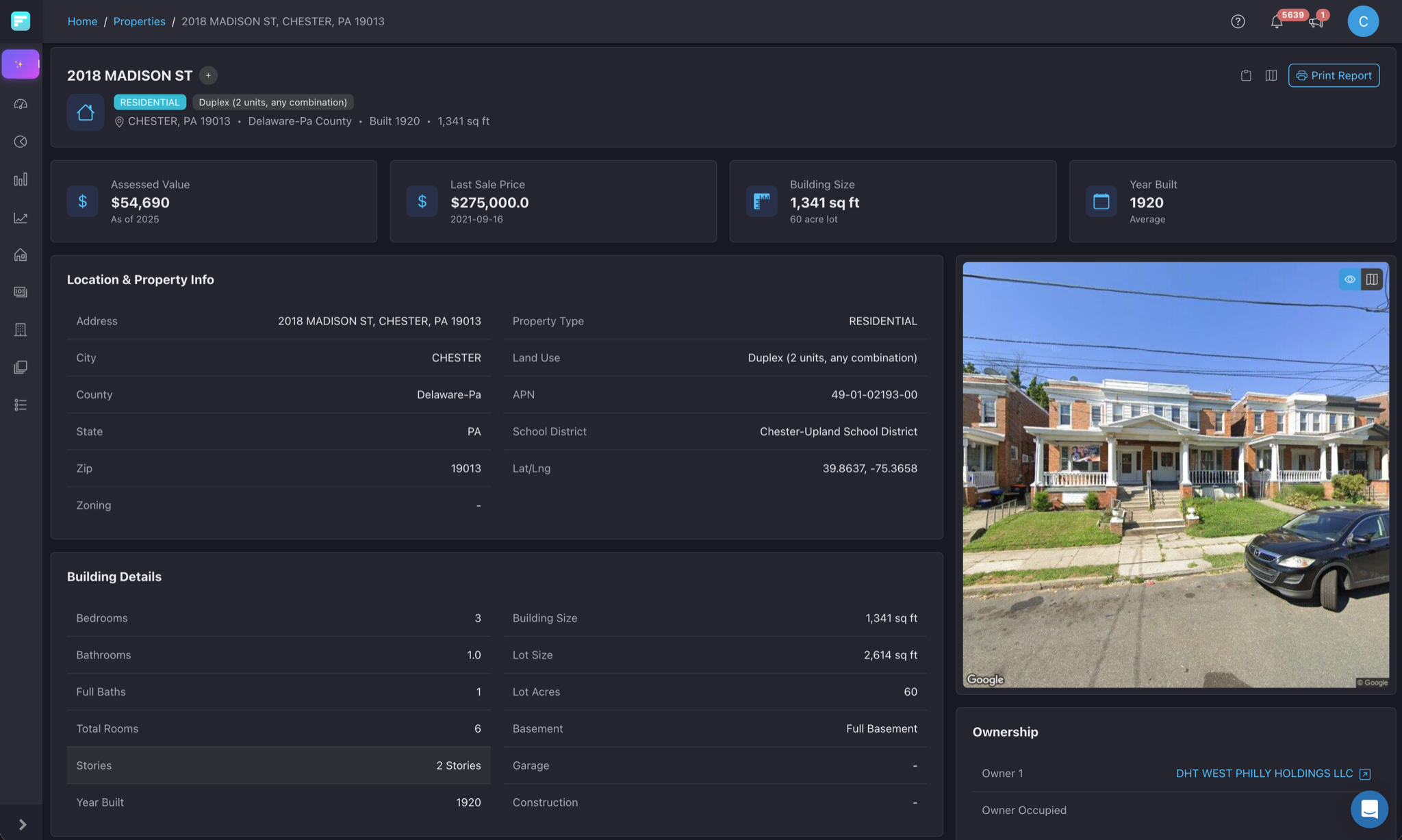

Property-Level Data

Granular property-level loan data and history for due diligence and market validation.

Transaction Activity

Browse recent transactions to understand market velocity and spot concentration patterns.

How do we monitor our partners over time?

Build watchlists of lending partners, markets, or borrower segments and get alerted when activity changes. Track partner origination consistency, geographic shifts, and volume changes so you can act on performance signals as they emerge, not months later in a quarterly report.

Explore capabilitiesPartner Watchlists

Monitor your lending partners' origination activity with alerts on volume changes, market expansion, and performance trends.

Market Alerts

Get notified when markets in your portfolio experience significant shifts in lending activity or competitive dynamics.

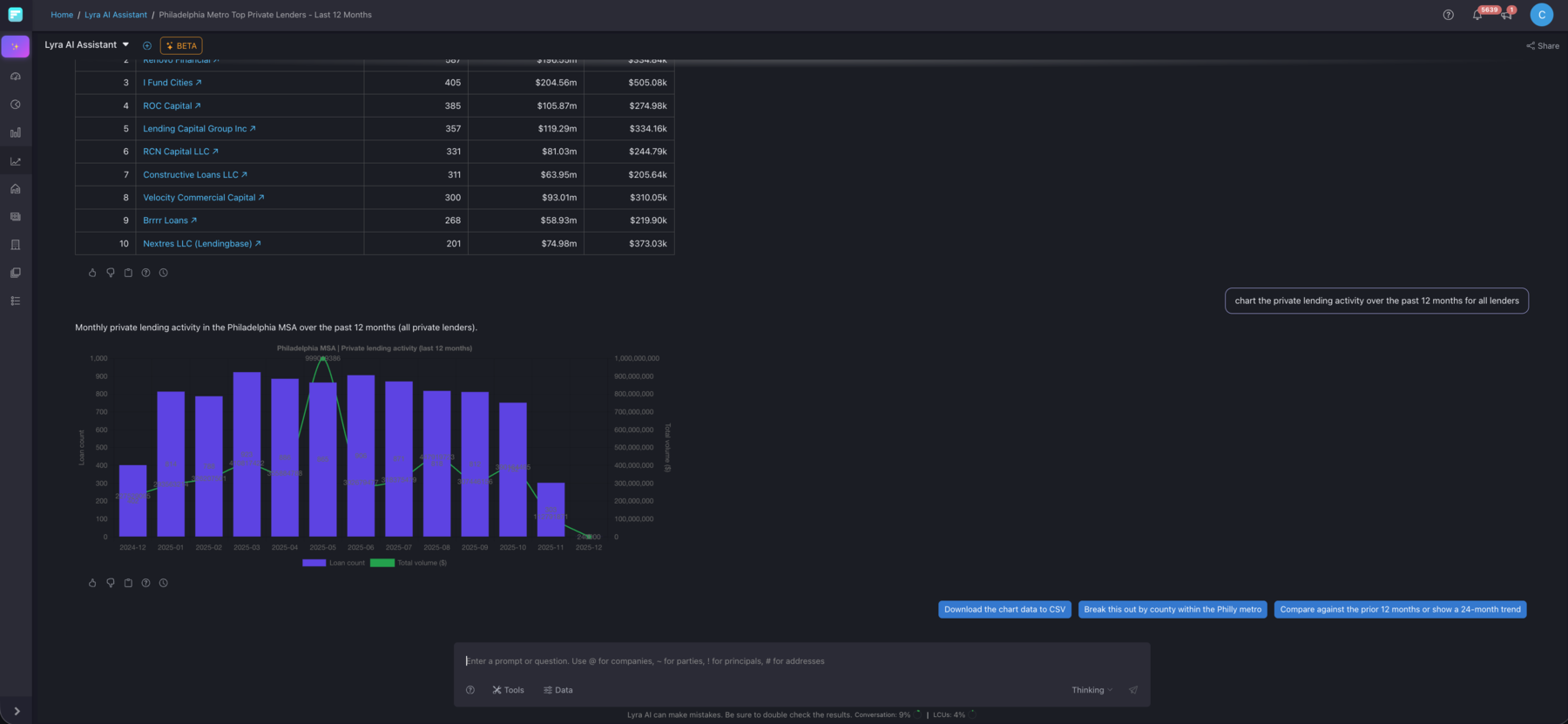

Natural language exploration of market data

Skip the dashboards and ask directly. Lyra translates complex market questions into instant, data-backed answers, from market sizing to partner benchmarking to exposure analysis. Designed for the speed capital allocation decisions demand.

Learn about LyraRecommended plan

The best starting point for capital providers & lps.

Enterprise

The complete picture: past, present, and emerging.

- Everything in National

- CRM and workflow integrations

- Advanced relationship and exposure mapping

- Custom data delivery and integration support

- Dedicated account management