Price risk with market-level precision.

Forecasa gives credit and securities investors the origination data and market context to evaluate private lending exposures, assess collateral markets, and monitor portfolio risk.

Without market clarity

- Collateral market health invisible between reporting cycles

- Concentration risk in loan pools discovered after pricing

- Lender behavior shifts undetected until earnings reports

- Due diligence relies on static, point-in-time snapshots

With Forecasa

- Real-time origination data in portfolio geographies

- Structural concentration analysis across borrowers and lenders

- Continuous monitoring of lender activity and market dynamics

- AI-powered risk signal detection across the full dataset

Your decisions, answered

Every critical question credit & securities investors face, mapped to the platform capabilities that answer it.

What's happening in the collateral markets?

Monitor origination trends, lending velocity, and market health in the geographies backing your credit exposures. Track the real-time activity beneath your portfolio positions, not just the lagging indicators.

Explore capabilities

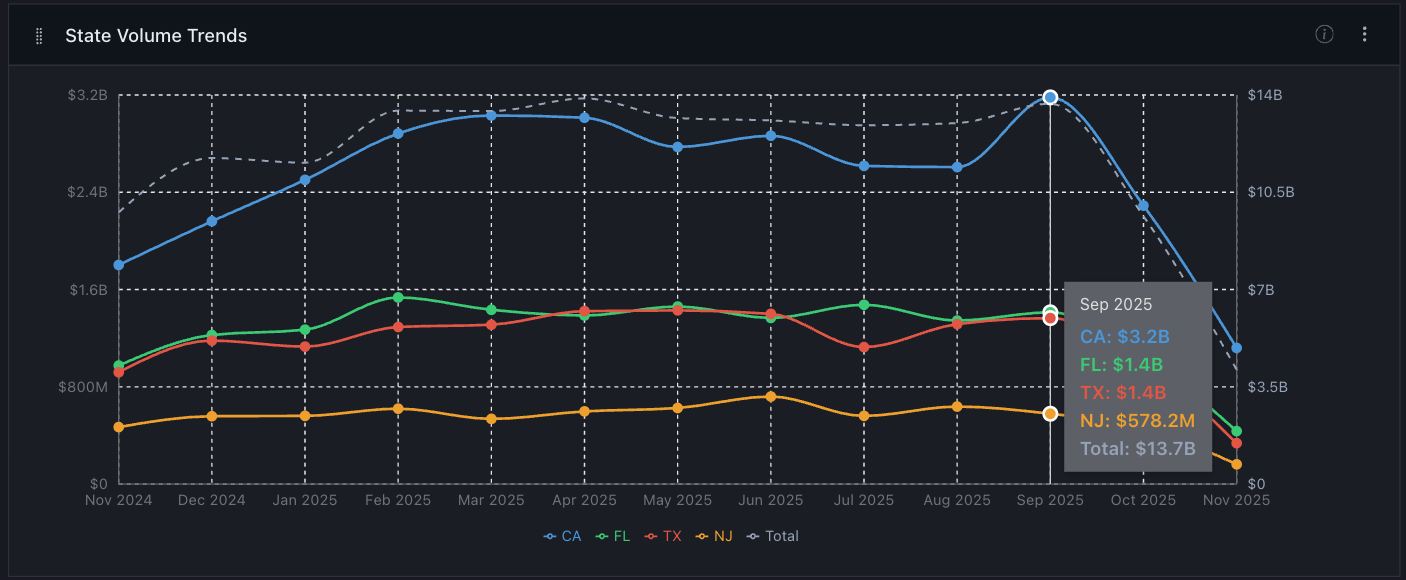

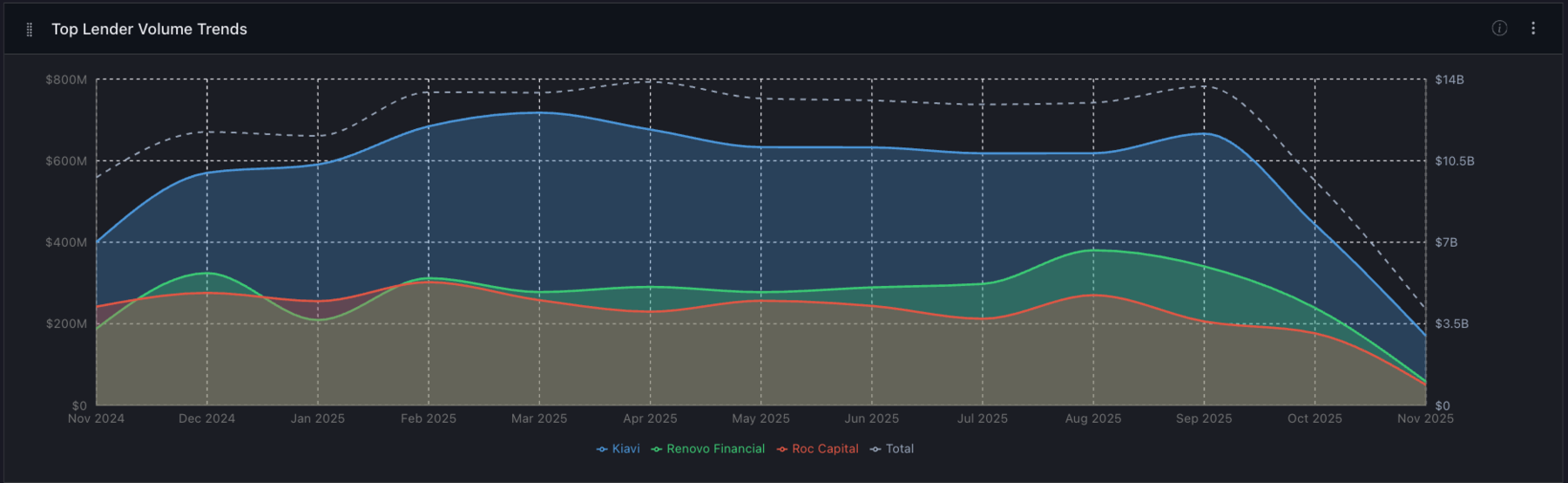

Volume Trends

Track origination patterns over time to detect shifts in the markets backing your portfolio.

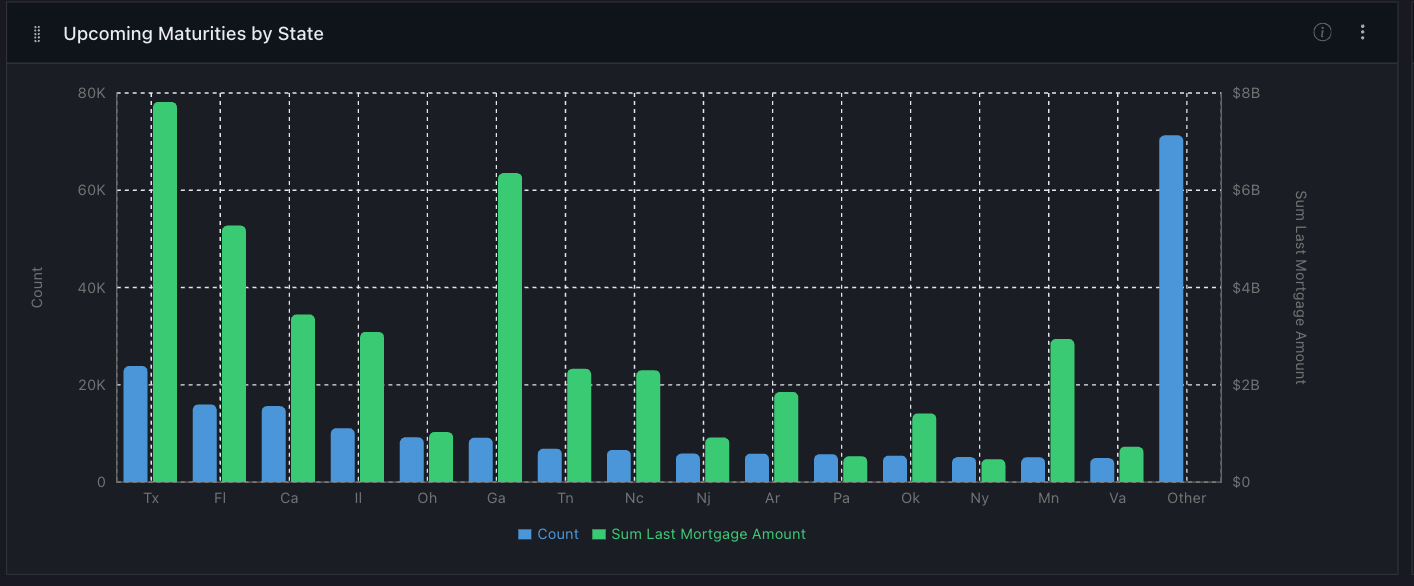

Maturity Analysis

Monitor upcoming maturities to anticipate refinance pressure and default risk across geographies.

How concentrated is the underlying exposure?

Analyze borrower, lender, and geographic concentration across loan pools. Track preforeclosure filings to detect early stress signals in collateral markets. Surface structural risks that traditional reporting misses before they become pricing events.

Explore capabilities

Preforeclosure Tracking

Monitor preforeclosure filings across your portfolio geographies to catch early default signals and assess collateral market stress.

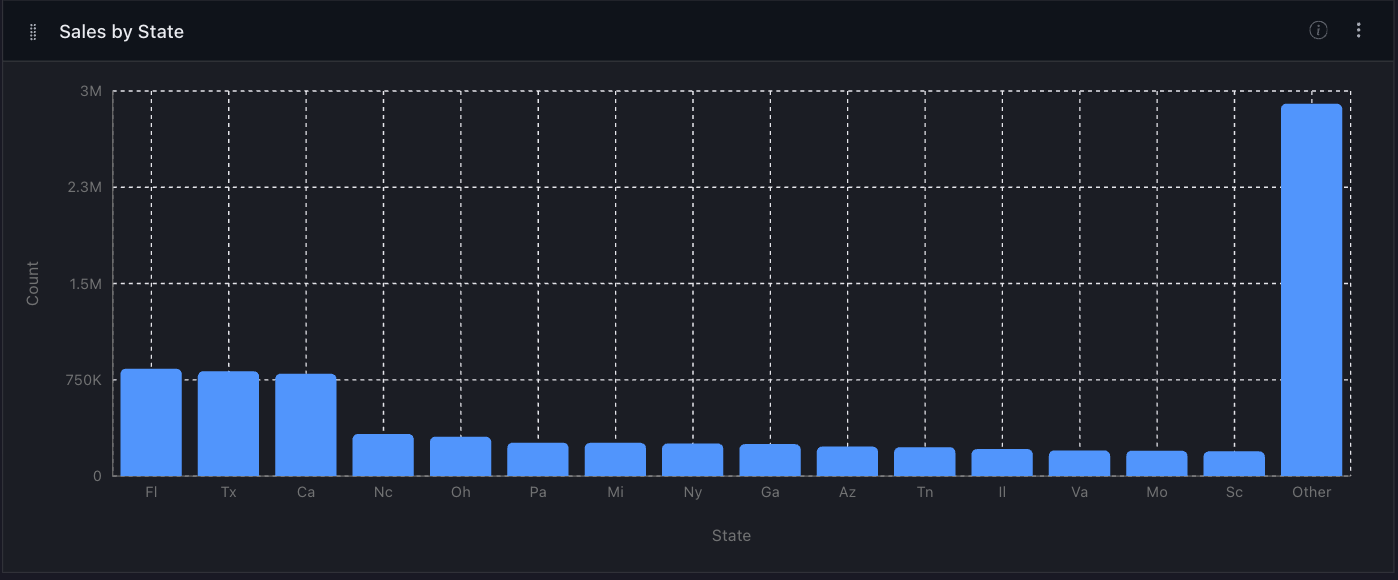

Geographic Concentration

Visualize lending concentration by state and identify portfolio-level risk hotspots with dashboard-level market health indicators.

Are origination trends shifting?

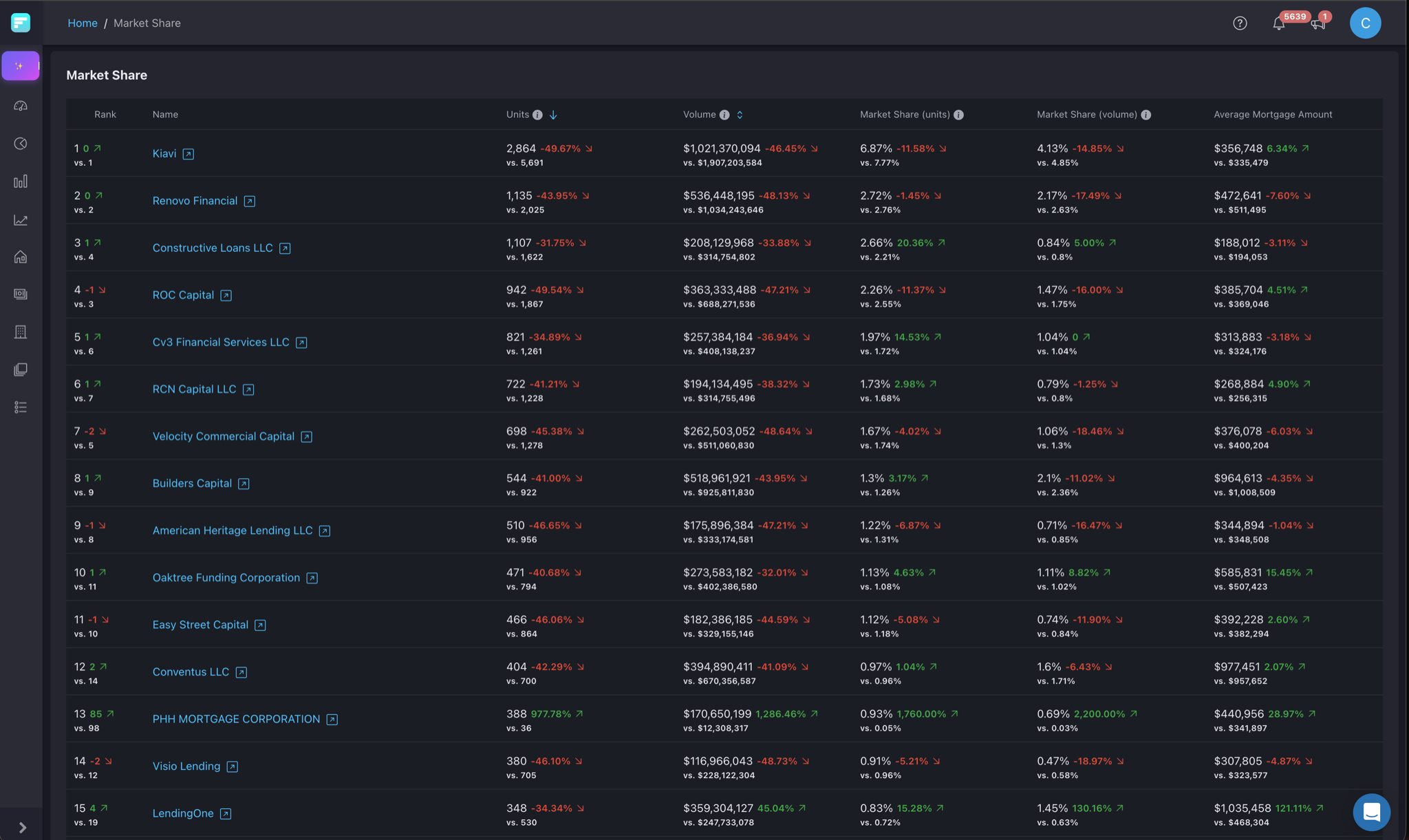

Track which lenders are growing, pulling back, or entering new markets. Run market share reports per MSA or state to understand the competitive dynamics that shape origination quality and ultimately impact your credit exposure.

Explore capabilities

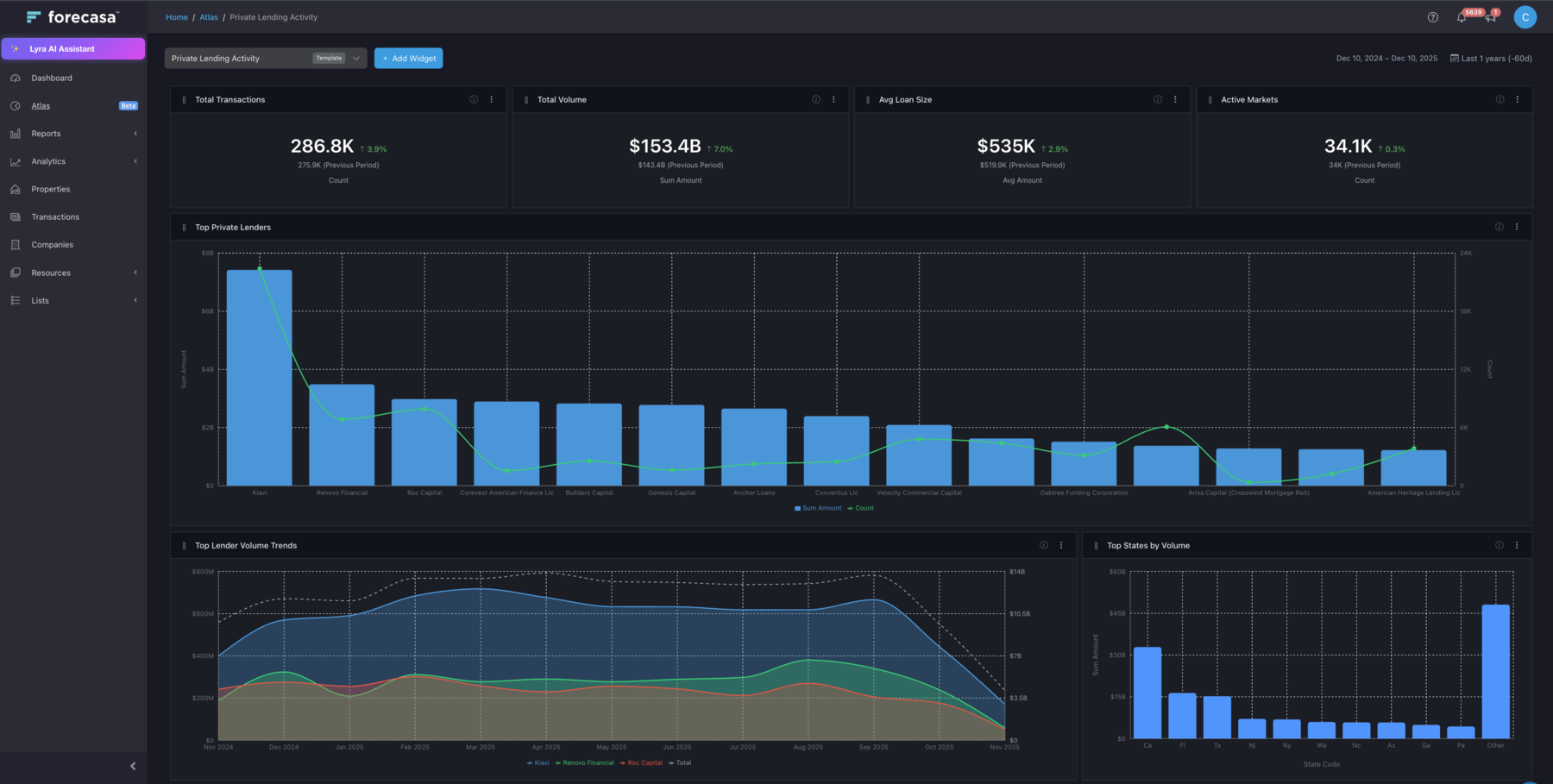

Lender Volume Trends

Monitor how lender origination changes over time to detect strategic shifts and pullbacks.

Lender Rankings

Benchmark lenders by volume, growth, and market share across geographies.

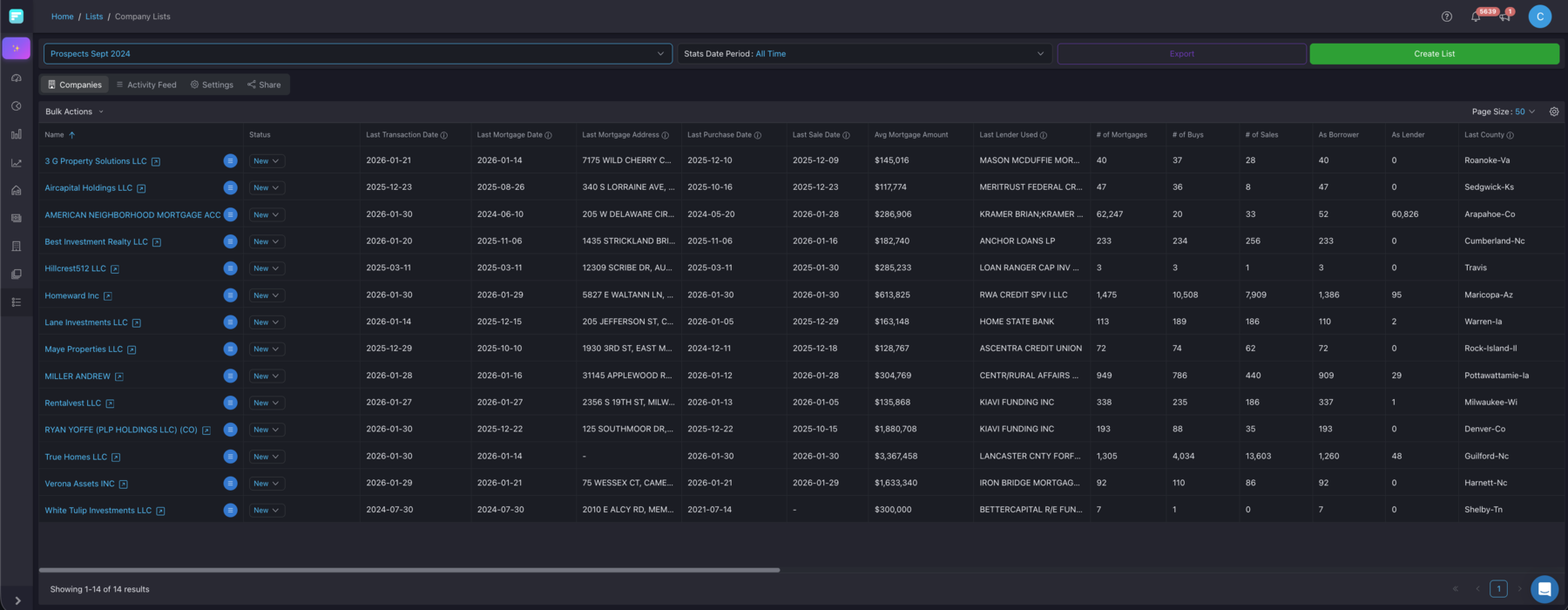

How do we monitor portfolio risk continuously?

Build watchlists of lenders, markets, or borrower segments tied to your portfolio and get alerted when conditions change. Track preforeclosure filings and origination shifts in real time so you catch risk signals as they develop, not after they've priced in.

Explore capabilitiesLender Watchlists

Monitor lenders in your portfolio for origination changes, market pullbacks, or geographic shifts that could affect credit quality.

Market Alerts

Get notified when collateral markets show significant changes in lending activity, new entrants, or concentration patterns.

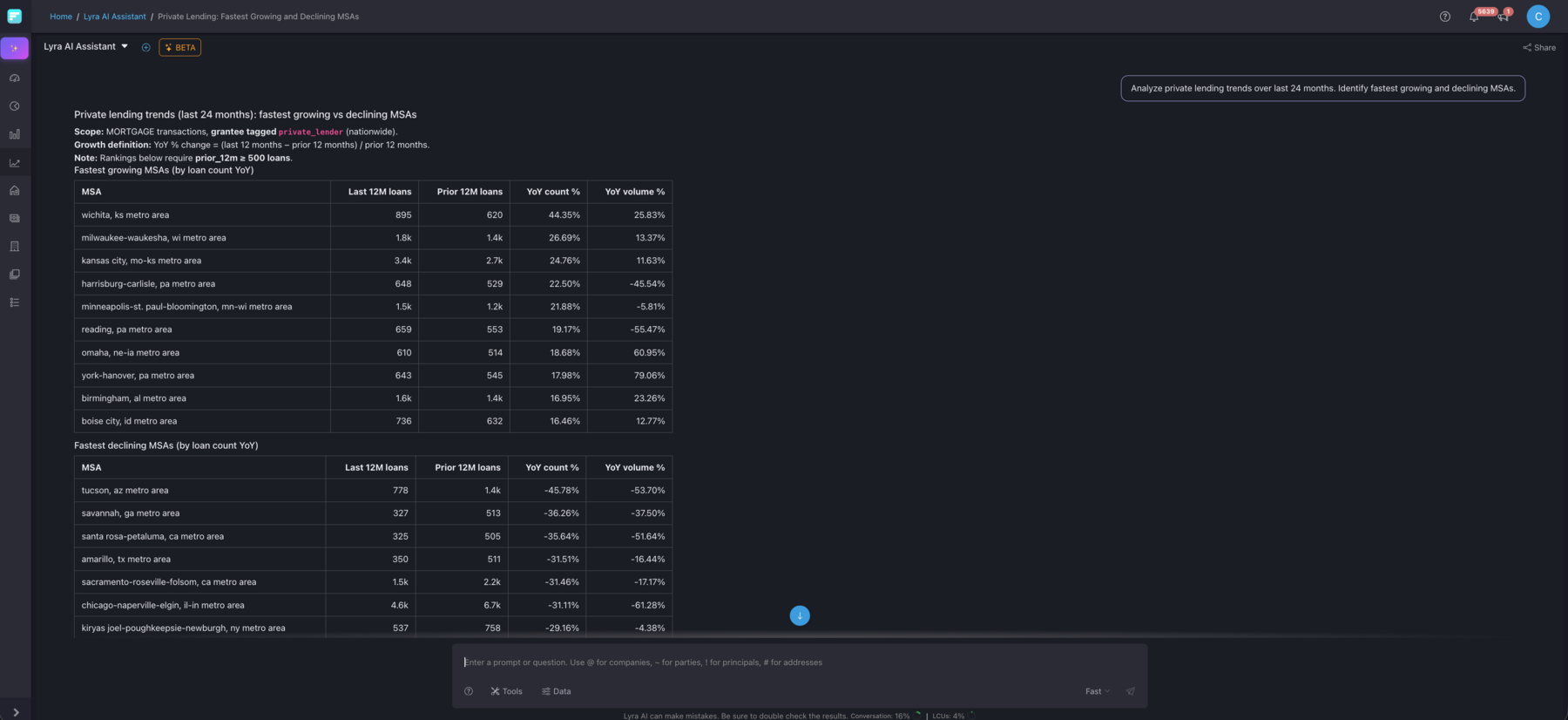

AI-powered risk signal detection

Ask Lyra about market conditions, concentration patterns, or trend shifts. Get analytical answers backed by the full origination dataset, faster than any research team. Every response cites its sources so you can validate the signal.

Learn about LyraRecommended plan

The best starting point for credit & securities investors.

Enterprise

The complete picture: past, present, and emerging.

- Everything in National

- CRM and workflow integrations

- Advanced relationship and exposure mapping

- Custom data delivery and integration support

- Dedicated account management