Deliver desired outcomes through decision-ready analytics and workflows

Every Forecasa capability maps to an outcome your team cares about. Not features for the sake of features, but clarity that changes how you operate.

Data coverage you can count on

We have identified...

Investors

Borrowers

Lenders

Loan Buyers

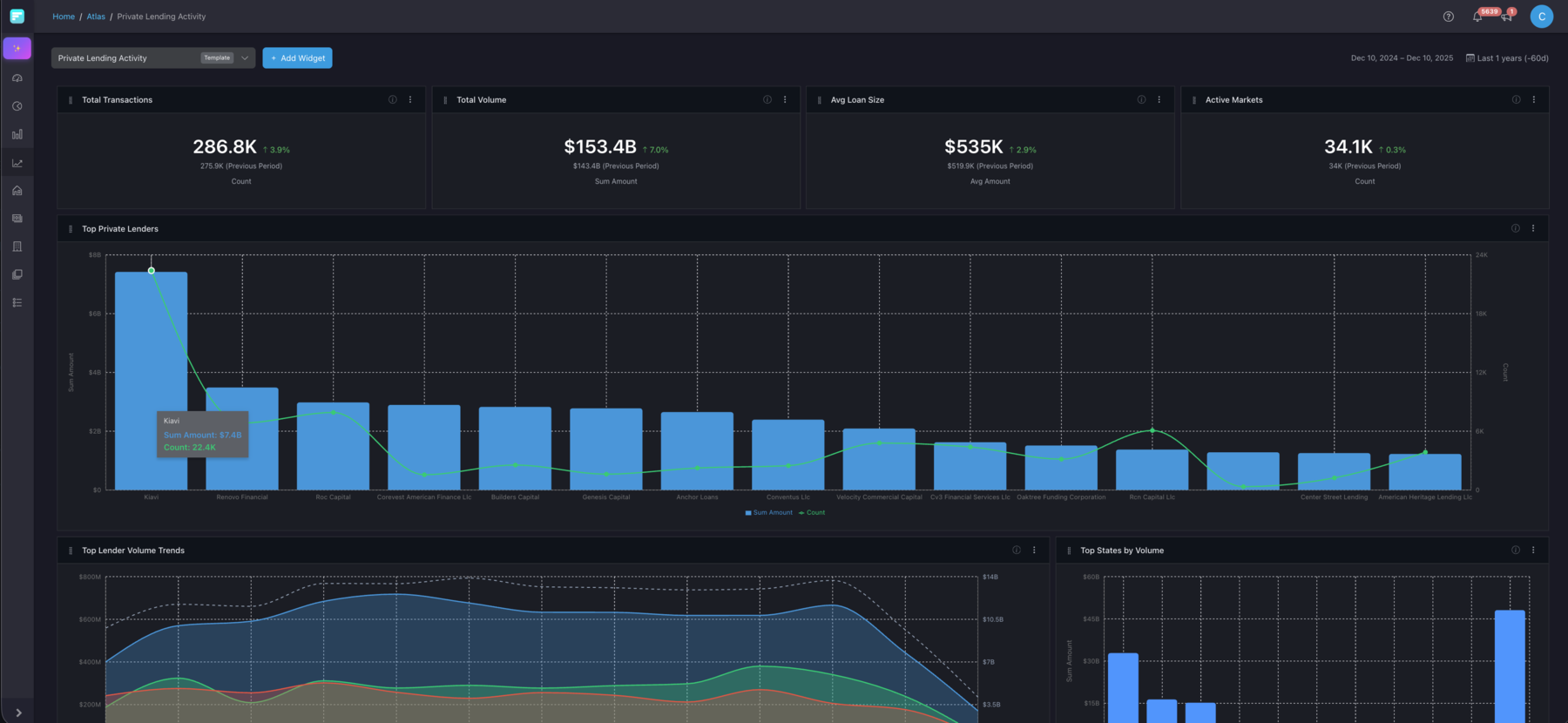

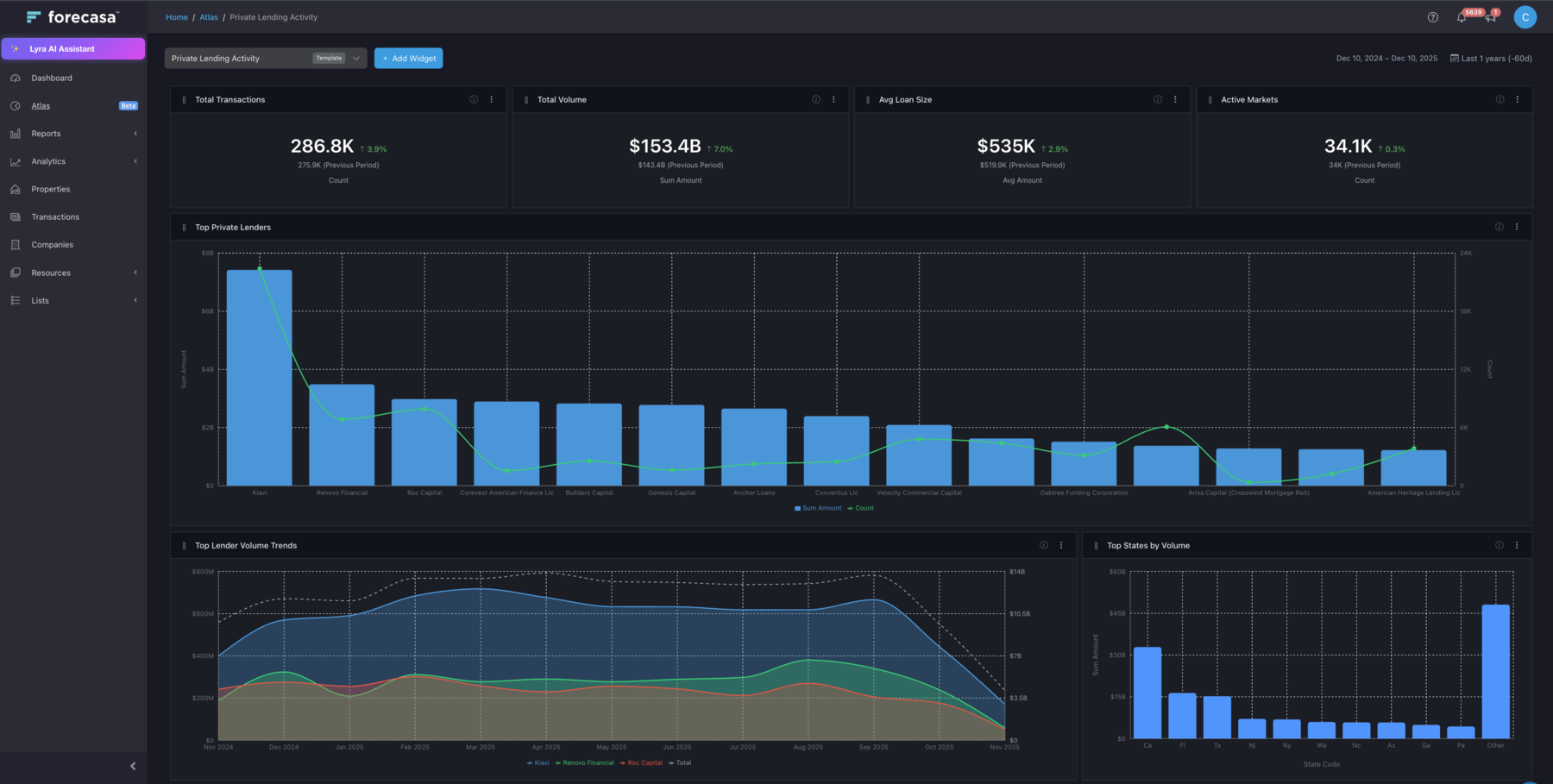

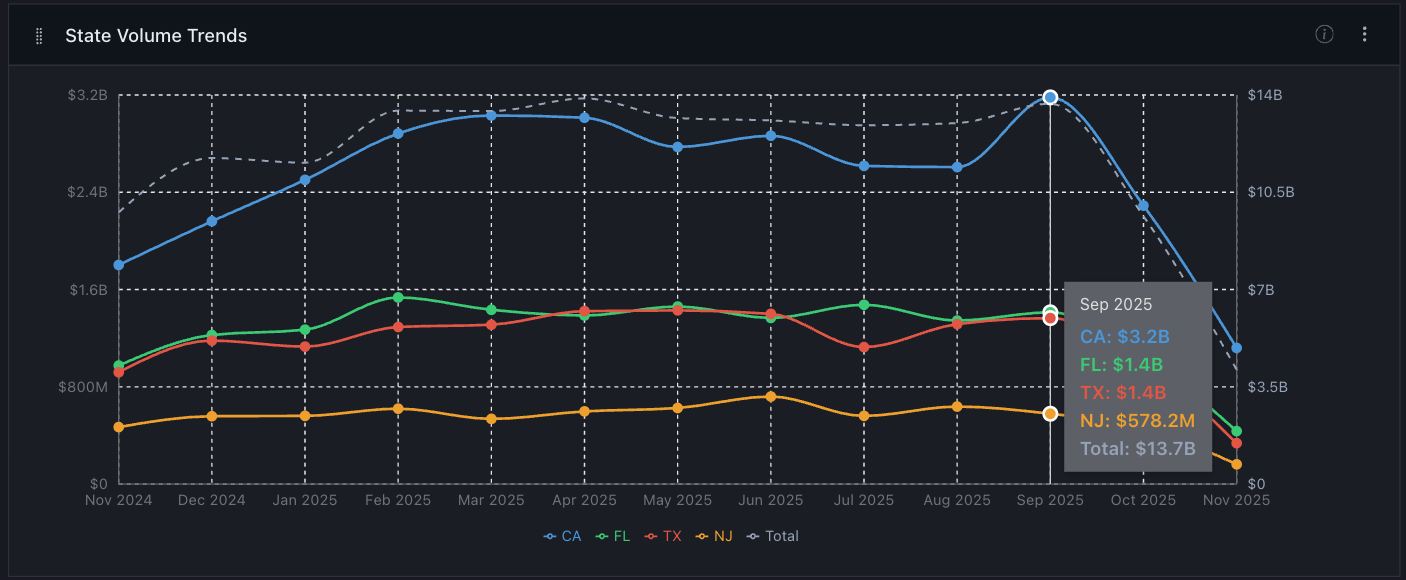

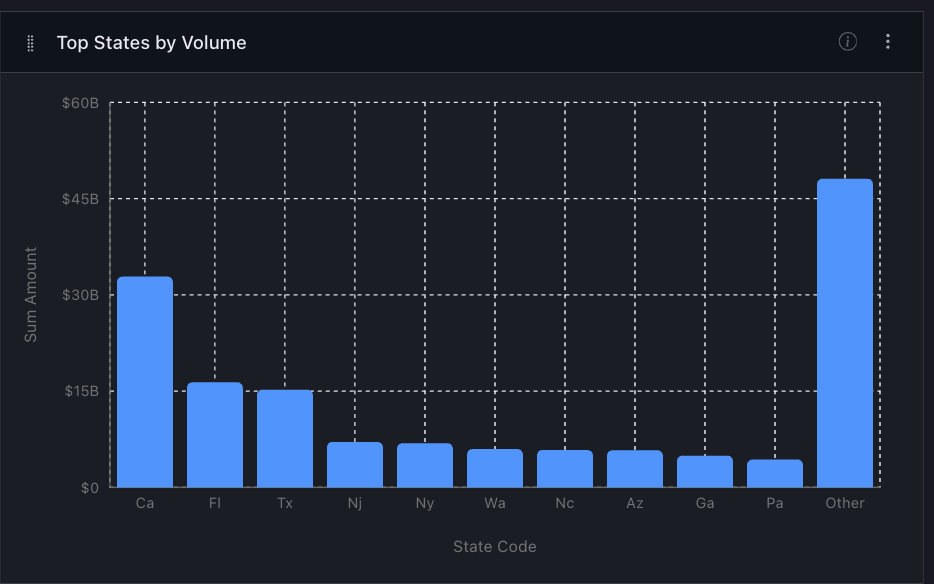

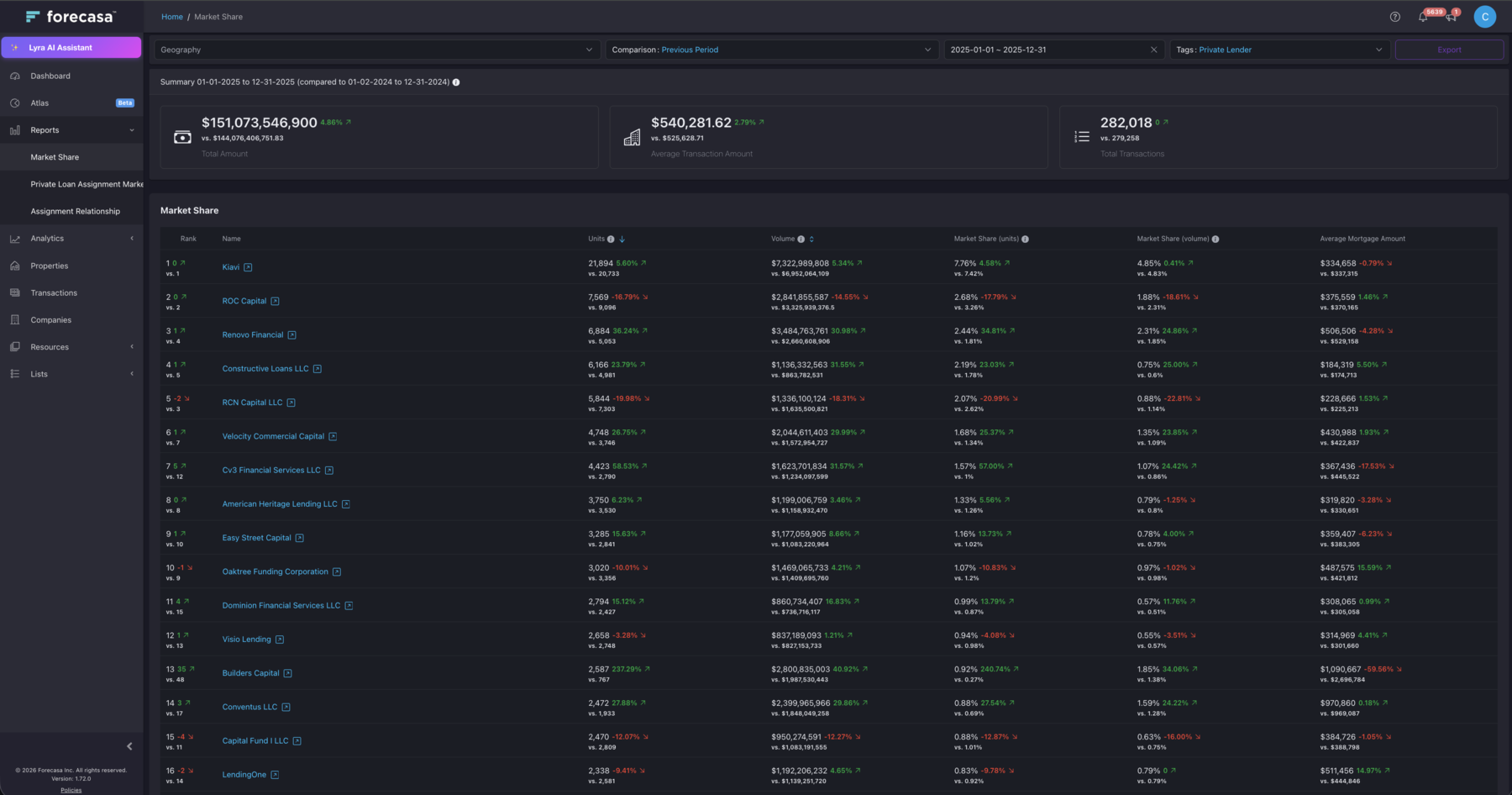

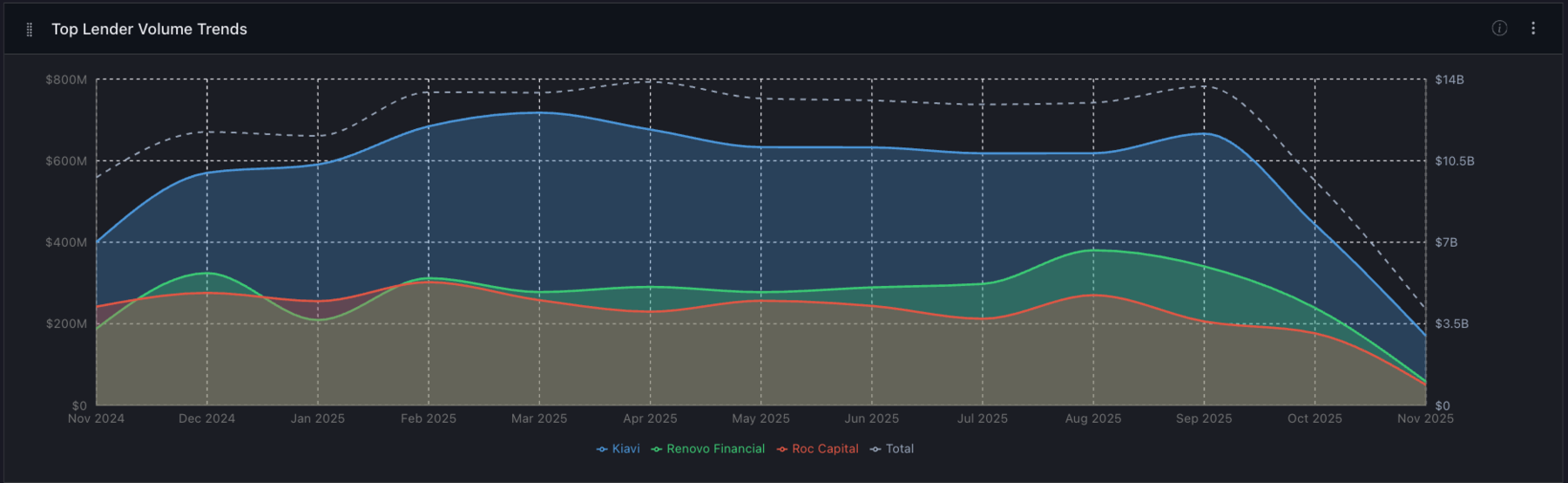

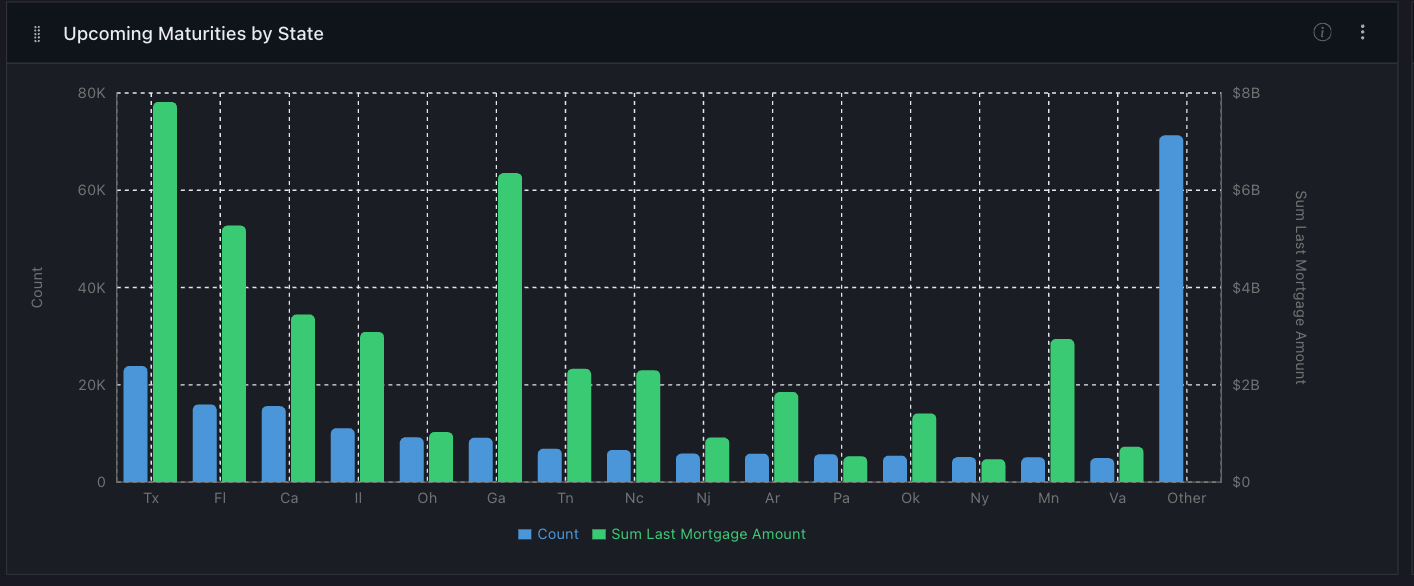

Market Clarity

See what's happening across private lending markets.

Understand lending activity, growth patterns, and market acceleration across geographies. Compare markets, track shifts, and identify where opportunity is building before others see it.

Used for

- Tracking origination volume and velocity by market

- Comparing metro and state-level lending activity

- Identifying acceleration or deceleration trends

- Benchmarking your presence against the broader market

Competitive Awareness

Know who's lending where and how fast they're growing.

Identify which lenders are gaining share, entering new markets, or pulling back. See geographic concentration, momentum, and strategic positioning across your competitive landscape.

Used for

- Tracking competitor origination activity

- Understanding geographic expansion or contraction

- Spotting new entrants in your core markets

- Evaluating competitive positioning across segments

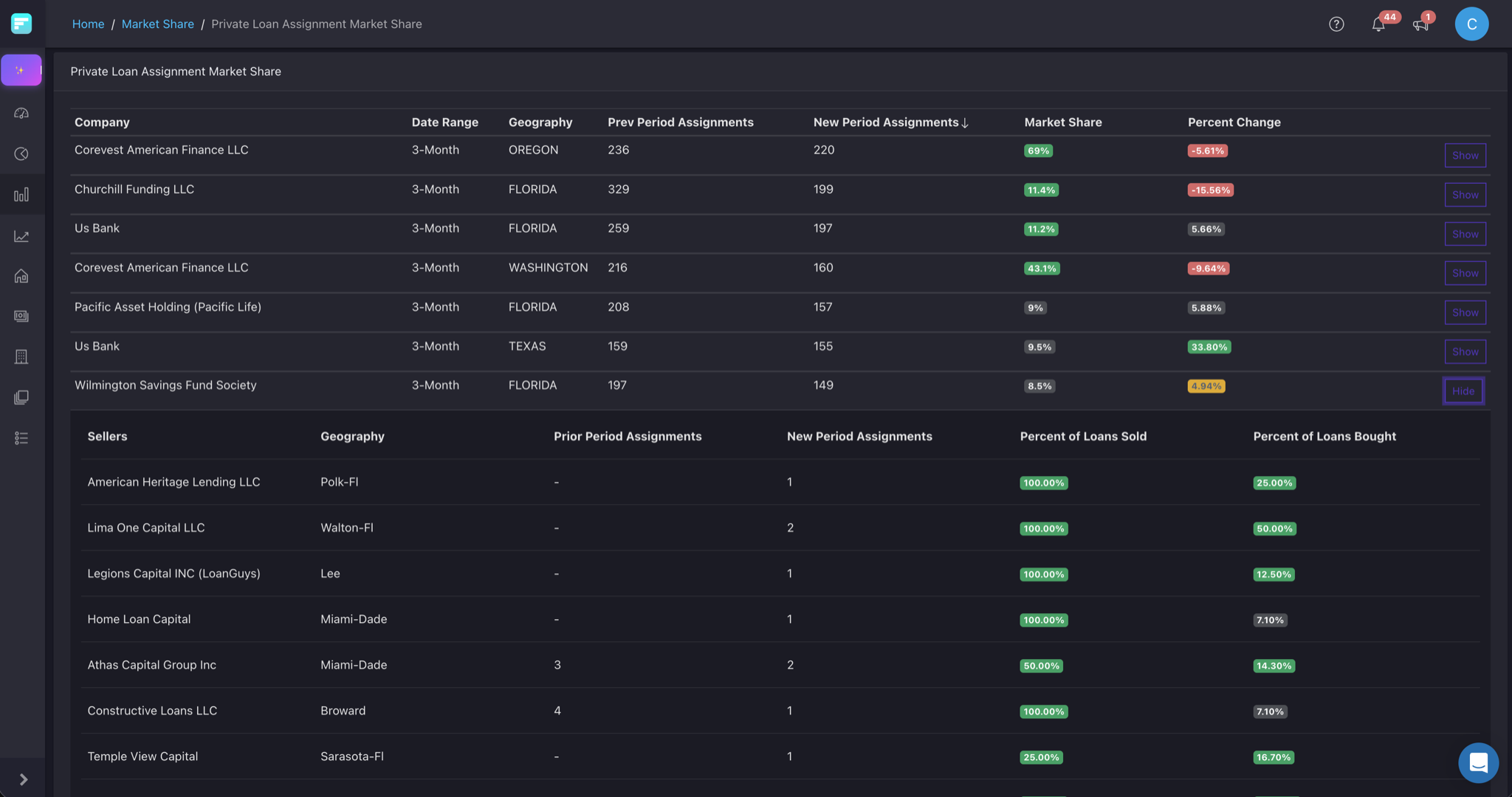

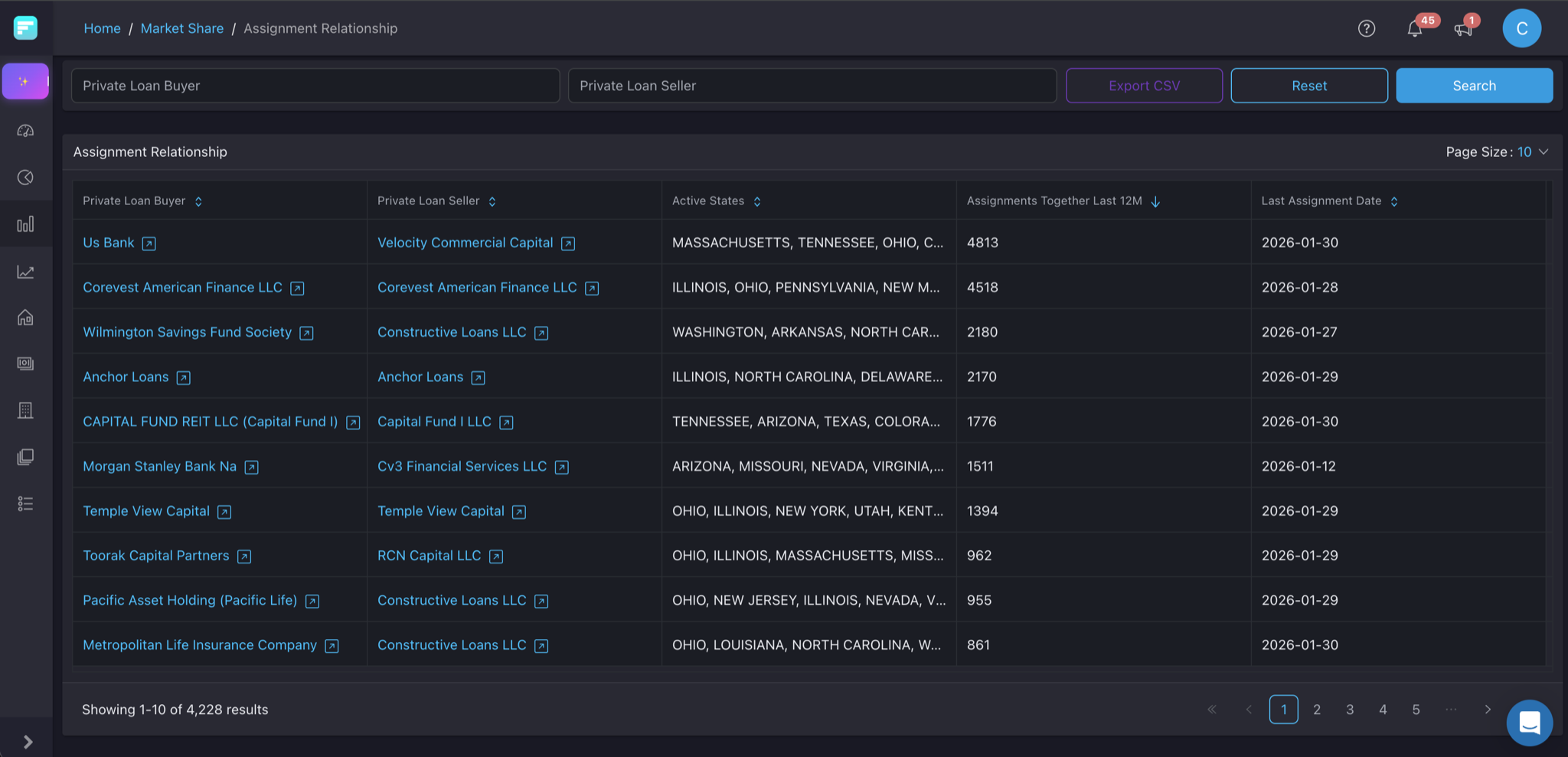

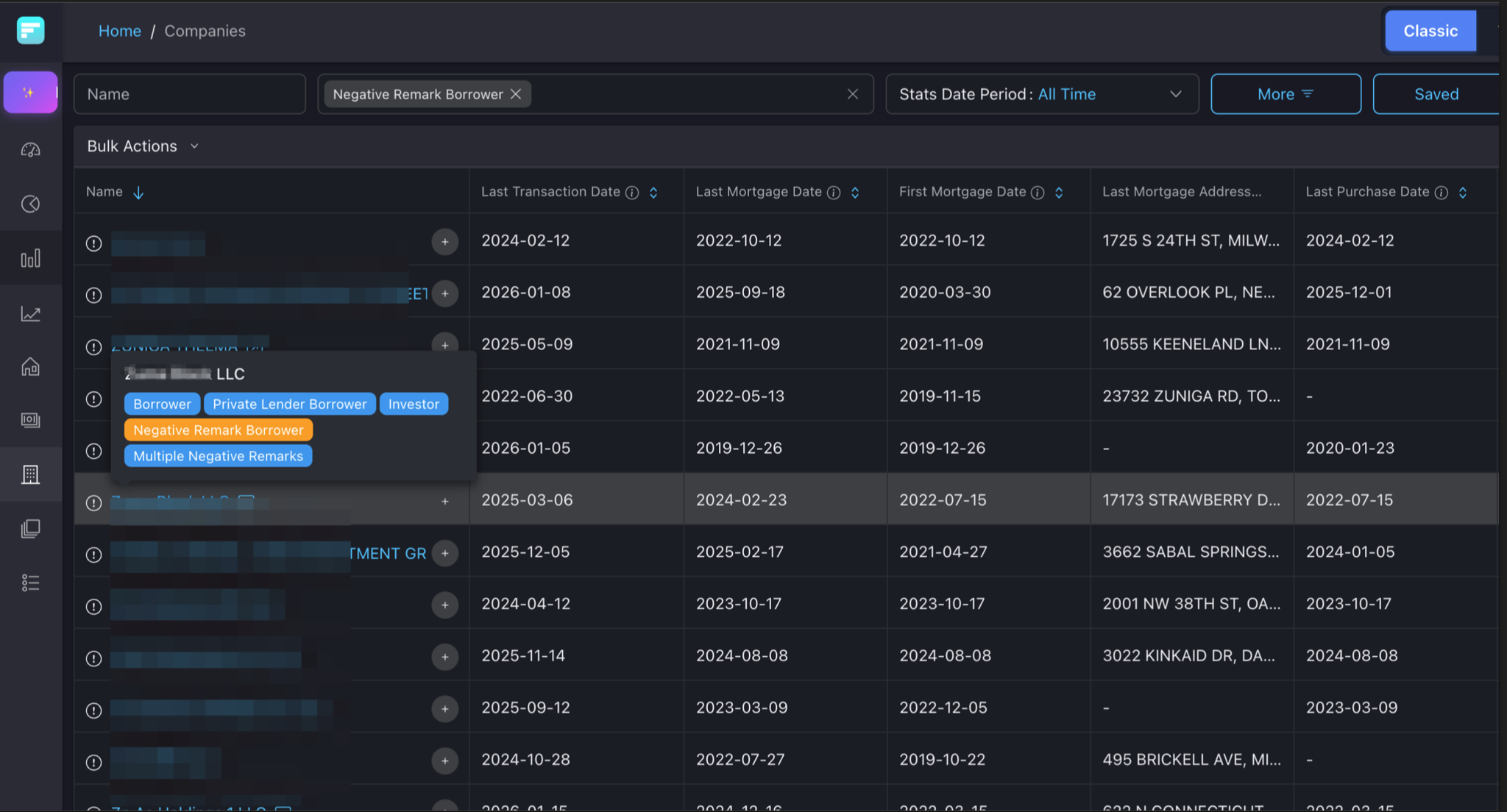

Relationship & Exposure Insight

Understand borrower behavior and lender patterns.

Analyze borrower relationships, repeat engagement, and cross-lender activity. Understand how exposure accumulates and where concentration patterns emerge across portfolios.

Used for

- Analyzing borrower loyalty and repeat patterns

- Mapping lender–borrower relationship networks

- Detecting cross-lender borrower activity

- Assessing portfolio-level exposure concentration

Risk Signals & Early Warnings

Catch concentration risk before it becomes a problem.

Surface early indicators of market stress, borrower overextension, and geographic concentration risk. Support underwriting decisions with data-driven risk context rather than gut feel.

Used for

- Identifying geographic or borrower concentration risk

- Supporting underwriting with market-level context

- Detecting borrower overextension across lenders

- Monitoring market-level stress indicators

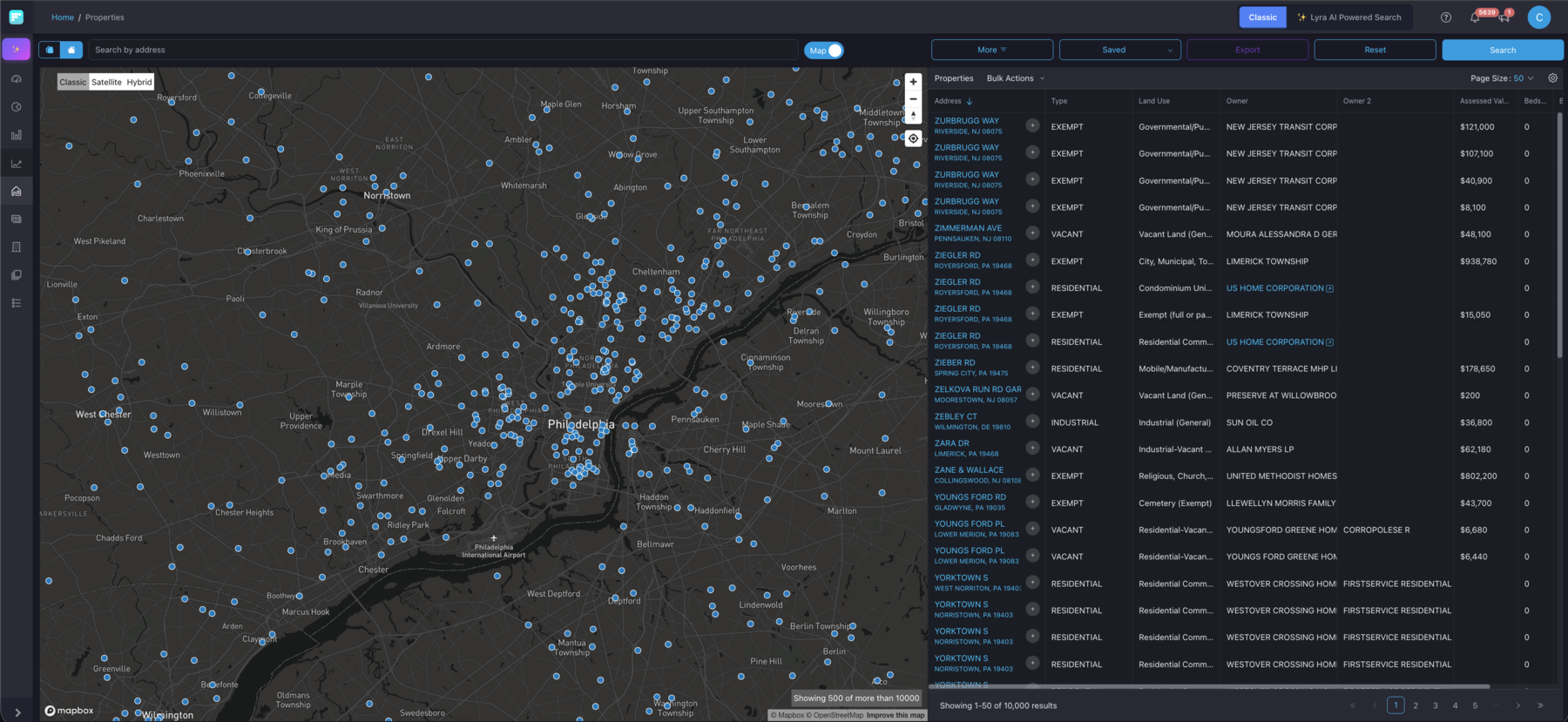

Decision-Ready Exploration

Go from macro trends to micro details, without waiting.

Explore markets from the top down or the bottom up. Drill into any market, lender, borrower, or property without analyst bottlenecks. Self-serve the answers you need to make decisions now.

Used for

- Drilling into specific markets, lenders, or borrowers

- Running ad hoc analyses without technical dependencies

- Answering strategic questions in real time

- Supporting deal-level diligence with market context

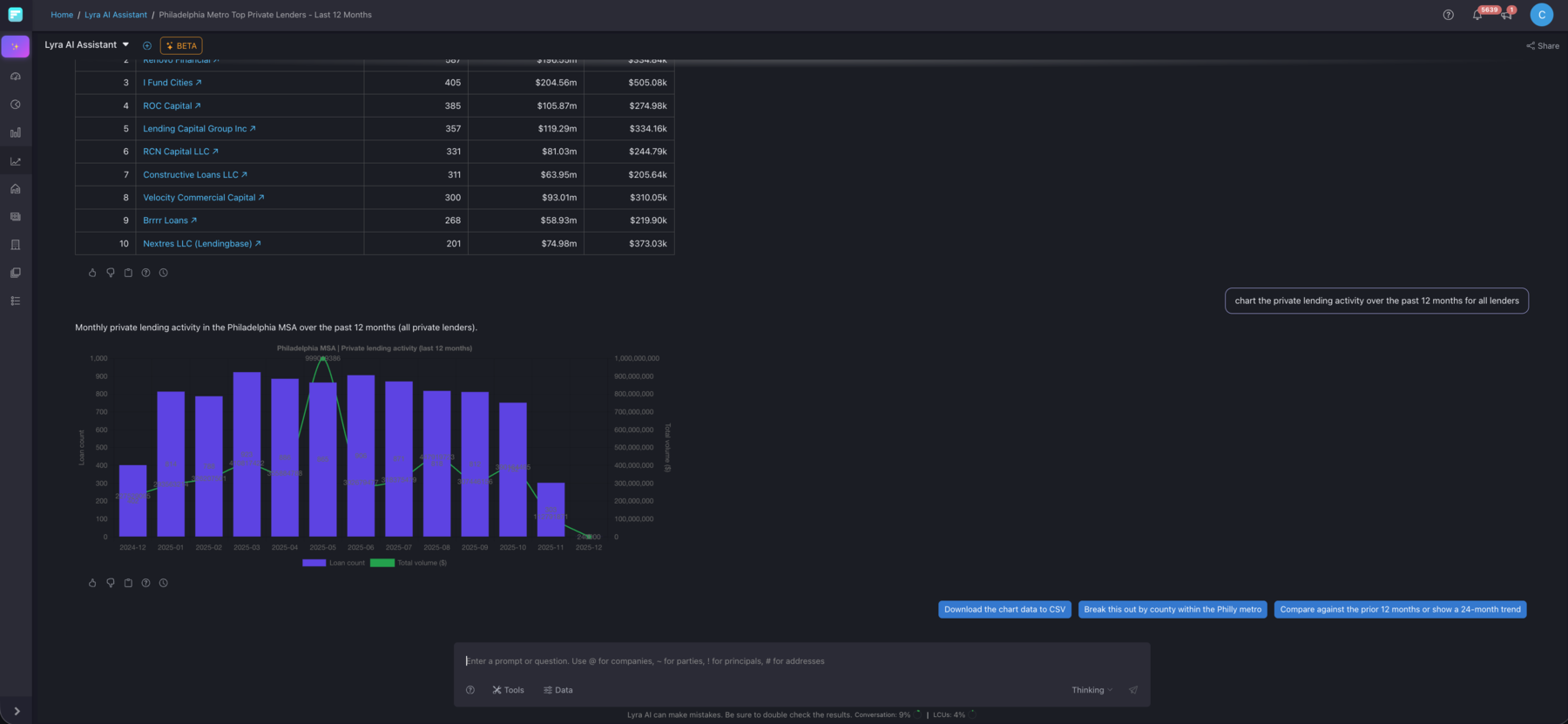

Faster Insight with Lyra AI

Ask questions in plain language. Get answers faster.

Lyra AI is built into every nationwide plan. Ask about markets, lenders, borrowers, or trends in plain language and get structured, data-backed answers without building dashboards or writing queries. Need more? Lyra AI Max unlocks higher usage limits and deeper analytical capabilities.

Used for

- Asking questions in natural language across all datasets

- Getting quick answers during meetings or calls

- Reducing time spent building custom reports

- Enabling non-technical team members to explore data